The good times are over. If you're Wall Street that is.

While much of the country has been wading through a seemingly endless deluge of shutdowns, job losses, financial fretting and a general climate of thinly-spread fear — wall street has been quite happy over the last four years.

For the past few years wall street has been reaping the benefits of outgoing President Donald Trump's efforts to dismantle regulation, unshackle big banks and broadly favor the rich in all matters of policy.

However, now that the Biden administration begins its march to the White House, fears are beginning to swell behind closed doors at many of the nations largest financial groups.

The primary cause of this long overdue fear and trembling?

Elizabeth Warren.

Although not announced in any official capacity at the time of reporting, Warren has a firm influence over much of Biden's incoming team — the team includes several people who share Warren's approach of being merciless on rogue banks and those in the financial industry that see the law as more go a guideline than a rule.

Warren has always been a worthy opponent of Wall Street and big banks hiding their skeletons, but her influence and sway has risen dramatically due to her thoroughly detailed plans, vigorous defense of working families, a well crafted media image and a presidential campaign that, although unsuccessful, only made her more popular.

Warren is said to be lobbying hard with Biden for the position of Secretary of the Treasury, and many in his circle see very little downside to letting her get to work on the big banks.

Meanwhile the transition team is being filled swiftly, and one of the main appointments for Wall Street to fret over is Gary Gensler.

A returning nightmare for big banks, Gensler was unrelenting when implementing the Dodd-Frank financial reform law that Wall Street opposed.

Gensler will lead the team tasked with the Federal Reserve, SEC and FDIC. A financial oversight veteran, Gensler was a major part of the Commodity Futures Trading Commission from 2009 to late-2014.

Although Gensler is a former Goldman Sachs banker, he is now viewed as a tough-on-Wall-Street ally of Warren.

Ed Mills, Washington policy analyst at Raymond James, explained to CNN why he's both a practical and strategic choice, "He made a lot of enemies in DC and the industry…The fact he's leading this is a signal to the Elizabeth Warren wing of the Democratic Party that they have a voice on financial regulatory picks."

So as wall street watches the Biden transition team carefully, they know that this is only the first shot fired of many that will cross during a 4 year term that will not offer them the comfort they so freely enjoyed under the outgoing President.

One small example is the growing concern that the Biden administration is keen to come down hard on overdraft fees, the banking industry's $11 billion gravy train that preys on the most vulnerable in the population. Biden's team is also preparing for lengthy confrontations with banks like Wells Fargo and others that have gotten away with an endless list of wrongdoing.

So as January 20th approaches, many in Wall Street will be checking their lawyers numbers still work and ensuring that the doors of the penthouse are locked twice.

Let us all bow before Gary, the Internet's most adventurous feline. Photo credit: James Eastham

Let us all bow before Gary, the Internet's most adventurous feline. Photo credit: James Eastham Gary the Cat enjoys some paddling. Photo credit: James Eastham

Gary the Cat enjoys some paddling. Photo credit: James Eastham James and Gary chat with Ryan Reed and Tony Photo credit: Ryan Reed

James and Gary chat with Ryan Reed and Tony Photo credit: Ryan Reed

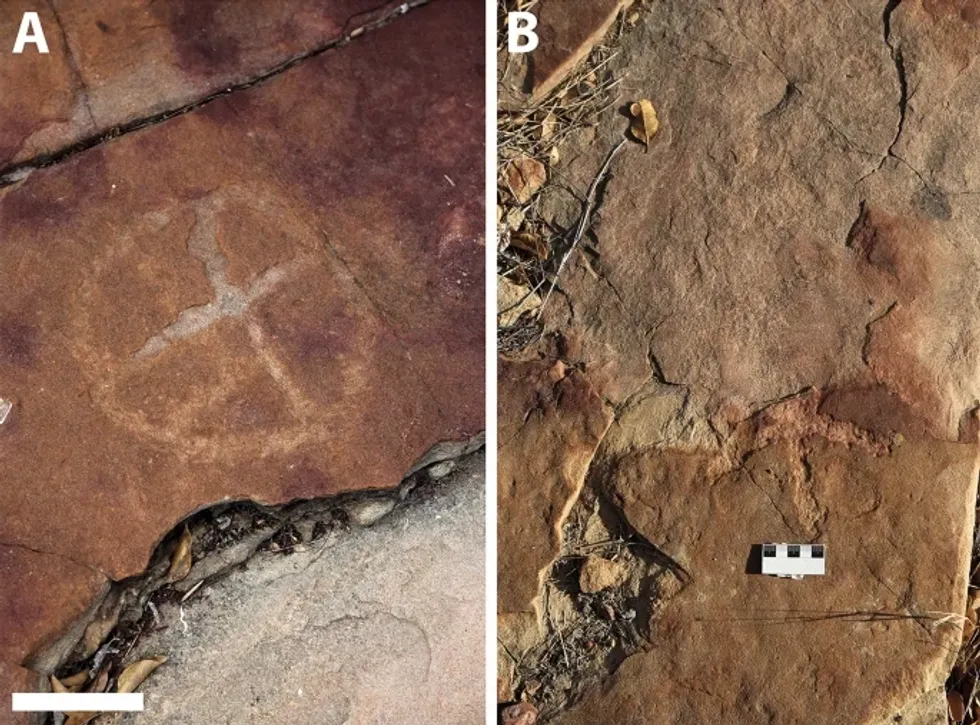

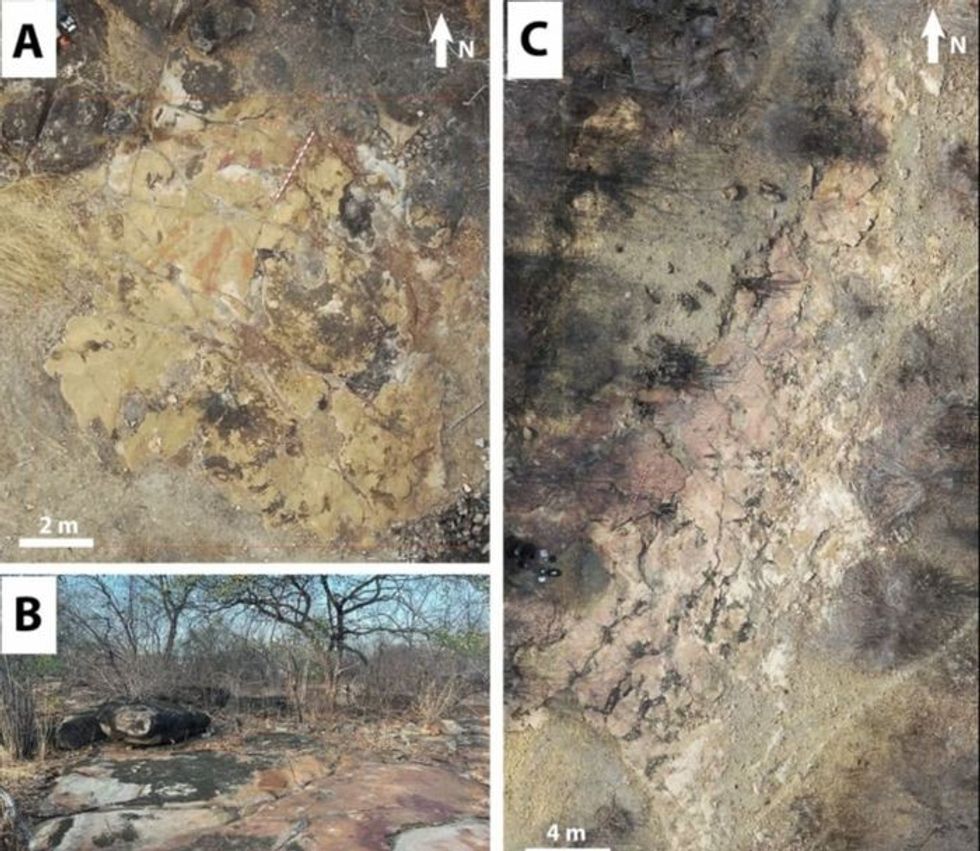

Rock deterioration has damaged some of the inscriptions, but they remain visible. Renan Rodrigues Chandu and Pedro Arcanjo José Feitosa, and the Casa Grande boys

Rock deterioration has damaged some of the inscriptions, but they remain visible. Renan Rodrigues Chandu and Pedro Arcanjo José Feitosa, and the Casa Grande boys The Serrote do Letreiro site continues to provide rich insights into ancient life.

The Serrote do Letreiro site continues to provide rich insights into ancient life.

The contestants and hosts of Draggieland 2025Faith Cooper

The contestants and hosts of Draggieland 2025Faith Cooper Dulce Gabbana performs at Draggieland 2025.Faith Cooper

Dulce Gabbana performs at Draggieland 2025.Faith Cooper Melaka Mystika, guest host of Texas A&M's Draggieland, entertains the crowd

Faith Cooper

Melaka Mystika, guest host of Texas A&M's Draggieland, entertains the crowd

Faith Cooper