To put it perhaps too simplistically, Americans have had a tough year—and it’s only April. The political climate in the United States has left us more divided than ever, leaving many to question what it means to be an American. But for more than 5,000 people, the answer is simply to stop being one.

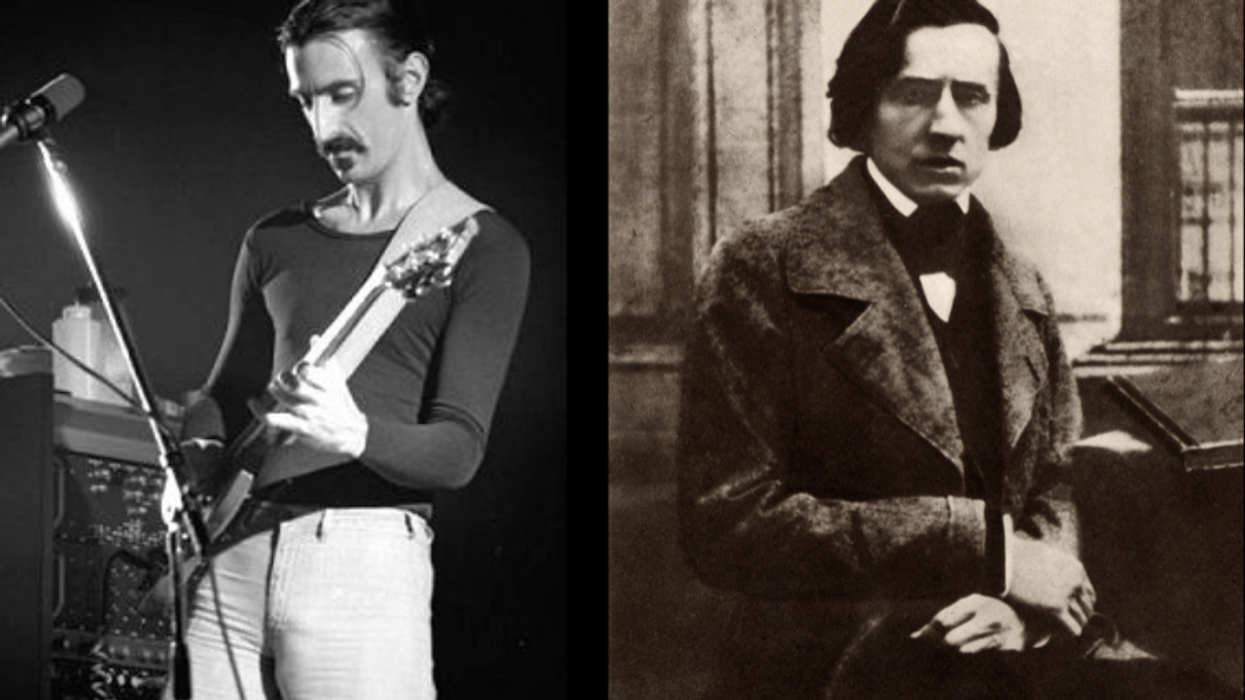

In 2016, a record number of American citizens living abroad decided to renounce their citizenship with the United States. In total, 5,411 people, accounting for a 26 percent year over year increase, decided to no longer be American citizens. The mass exodus picked up steam in the fourth quarter of 2016, just after Donald Trump was elected president. Among those who renounced their citizenship is Boris Johnson, the U.K. politician and former mayor of London.

But here’s the thing—these men and women aren’t running away in droves because of our new commander in chief. Instead, they are fleeing thanks to America’s bizarre tax laws.

"It's increasing at an exponential rate," Andrew Mitchel, an attorney who began compiling quarterly lists of expatriates released by the IRS, told USA Today in February. The reason, Mitchel added, is because of the uniquely American law that taxes people based on citizenship, not by location. Only the United States and Eritrea, a country in northeast Africa, tax worldwide income no matter where a person lives.

"Foreign banks are basically acting as the police to flush these U.S. citizens out of the bushes so the IRS can see them. That's when people start to realize, 'Oh, I'm not filing, and I should be filing,’” Mitchel said.

Part of the reason foreign banks and the U.S. government are cracking down on overseas citizens is due to the implementation of the Foreign Account Tax Compliance Act. FATCA, which passed in 2010 and was later signed by President Obama, is a federal law enforcing the requirement of citizens, including those living outside the United States, to file yearly reports on their non-U.S. financial accounts. It also compels foreign banks to gather the financial information of Americans for tax reasons and to turn that information over to authorities. Instead of doing that, many banks simply refuse to work with American citizens.

In March of 2017, more than 20 free market groups sent a letter to the White House urging Trump and his administration to roll back the law, saying FATCA "has ensnared innocent Americans in an appallingly draconian scheme that true wealthy tax evaders can still easily avoid. It treats any American asset held abroad as tantamount to criminality, demanding reams of private financial data without the need for a warrant or a showing of probable cause."

Take, for example, Boris Johnson, mentioned earlier, who renounced his American citizenship in 2016. Johnson, who was born in the United States, decided to sell home in London, but with it also had to pay Uncle Sam. “I think, it's absolutely outrageous,” Johnson said at the time of having to pay taxes on the sale. “Why should I? I think, you know, I'm not a—I, you know, I haven't lived in the United States for, you know, well, since I was five years old."

Even if you want to give up your American citizenship, it’s a ridiculously complicated, lengthy, and bizarre process. As ExpatInfoDesk.com describes:

First you must obtain a second passport

The State Department will deny anyone the right to renounce their U.S. citizenship if they don't have a second passport. If your parents, or grandparents, were not born in a different country that will be very, very difficult. Otherwise, you run the risk of being stateless, thus living without the protections of any government which can be extremely dangerous.

Next, fill out a boatload of paperwork

DS-4079: Information for determining possible loss of U.S. Citizenship

DS-4080: Oath of renunciation

DS-4081: A signed statement that you understand the consequences of renunciation.

DS-4082: A paper signed by a witness attesting to your renunciation

DS-4083: Certificate of loss of nationality

Now, book an appointment to renounce your citizenship in person

Seriously, you need to stand in front of someone in an embassy, hopefully in the country you’d now like to be a full-time citizen of, and renounce your citizenship in the United States. You then hand over your passport and you’re done. But remember, there are no take backs. Once you say it, it’s over forever. Oh, and don’t forget to pay the $2,350 fee, which by the way, is the the highest fee in the world for renouncing citizenship.

Lastly, file your last U.S. tax return

Yep, even after you bid adieu to the United States you still have to pay the man. Your final tax bill will be from January 1 to the last day of your citizenship. But you may need to wait a while to make this last tax bill happen. As The Atlantic reported, to actually surrender citizenship, a person “has to have been compliant with all tax laws, including interest and penalties, for five years.” Hopefully you’ve been paying your bills.

Be warned: Once you give up your citizenship, you may also be giving up your right to enter the United States ever again. If the government determines you renounced your U.S. citizenship to avoid paying taxes they can bar you from re-entry.

*Correction: The original article stated Boris Johnson paid taxes on the sale of his home in New York. He paid capital gains taxes on the sale of his home in London.