30 Days of GOOD (#30DaysofGOOD) is our monthly attempt to live better. This month we're going "Back to School" and committing to learn something new every day.

Home economics isn't all sewing buttons and baking cakes. It's also about learning to spend money wisely. (Read about the history of home ec at Smithsonian magazine.)

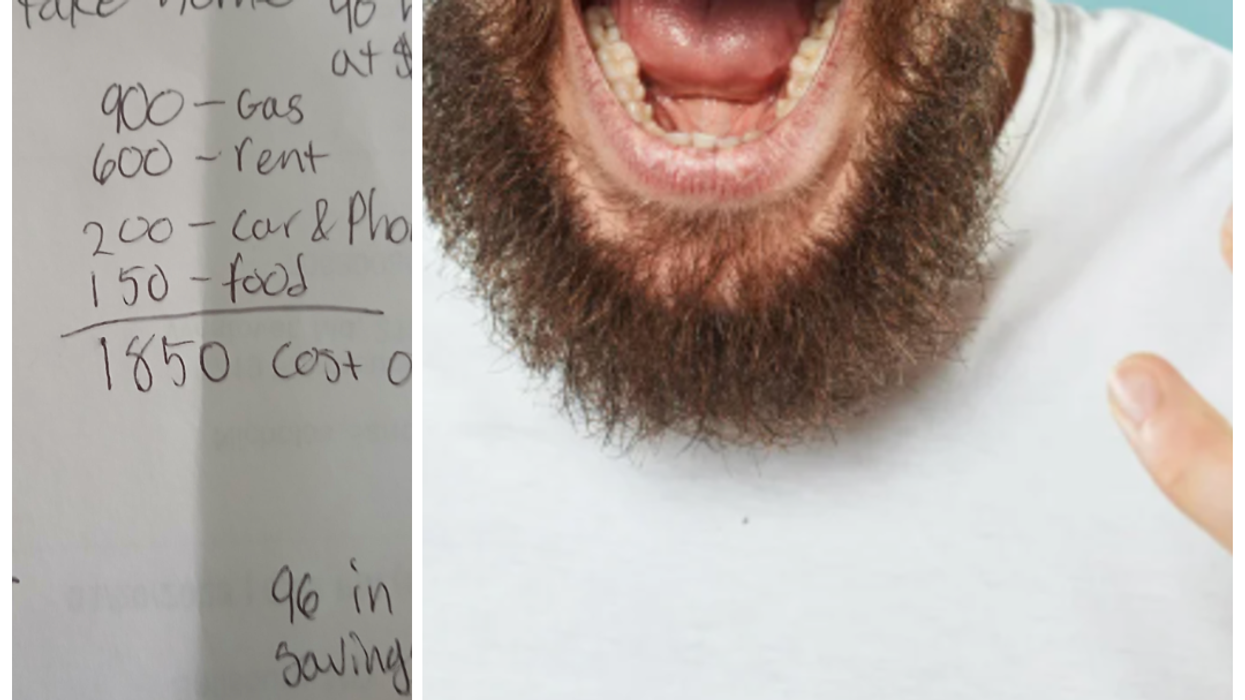

Today’s task is to brush up on an important life skill, managing a household budget. If you haven’t kept a close eye on your spending, this may seem a bit overwhelming at first. Don’t panic when you see all of your expenses out in the open. By learning a few basic principles, you can take control of your budget in no time.

First, you want to start tracking your income and spending. You can do this with a simple spreadsheet, but there are also a number of free tools available such as Mint.com and Buxfer. These tools have some extra advantages, because they’ll automatically categorize your spending and send you easy-to-read reports so you can learn more about your habits.

Once you start tracking your spending, it’s time to observe and adjust. There are a number of “money ratios” out there, but two big ones are spending 30% of your income on housing (this includes rent or a mortgage) and saving 10% of your paycheck. You don’t have to follow these numbers exactly—and these ratios aren’t right for everyone—but they are a good reference point.

When you’re ready to get granular with your budget, LearnVest is a great resource for learning more about your spending habits and making more informed financial decisions. Creating a basic account is free, and a number of different financial boot camps are available that cover topics such as cutting costs and shopping intelligently.

A critical area of your budget is your product consumption. There are more products, brands, and advertisements out there than you can shake a stick at, and part of keeping a balanced budget is making informed purchases. Before you go shopping, consult a few consumer education sites like Consumer Reports or GoodGuide to learn the truth behind the labels.

If you happen to be a homeowner, it’s a good idea to set aside some cash for both routine and unexpected repairs to your home. Sudden problems such as a flooded basement or storm damage can cost anywhere from $1,500 to $10,000, so it’s important to be prepared. As a general rule, you should save one to three percent of your house’s initial price each year for home maintenance expenses. To learn more about the most important areas of your house to maintain, consider signing up for BrightNest, a free home maintenance site that provides customized tasks and tips to help you keep your home in great shape.

About BrightNest

BrightNest is a free online service that provides people with the tools, tips, and motivation they need to keep their home in great shape and save money. Sign up for personalized tips and weekly reminders and visit our blog for more ideas and inspiration on home decor, cleaning, organizing, DIY projects, and much more.