This is troubling. In the latest—and boldest—move in the campaign against Muhammad Yunus, the Bangladeshi government has issued an order removing him from his Nobel prize-winning Grameen Bank. The government is using a special regulatory law created just for Grameen, which, it says, includes the power to fire Yunus as managing director of the pioneering microlending organization he founded in 1983.

The official reasoning for the order is that Yunus, at 70, is too old for the post, citing a provision of the law that sets a mandatory retirement age of 60. Yunus accepted the formal title of managing director in 2000. The Grameen Bank, however, says Yunus is staying put.

The backstory here is what many are calling a vendetta by Prime Minister Sheikh Hasina who has accused microlending of "sucking blood from the poor." We posted on this earlier with plenty of links to responses if you want to catch yourself up. But the quick version is that Yunus made a powerful enemy of Hasina when he announced he might start a political party shortly after a 2007 military coup. At the time, Grameen was still in the spotlight from the 2006 Nobel Prize. Yunus never did start the party, but the announcement was taken as direct threat to Hasina and other powers that be. Yunus is arguably Bangladesh's most famous man and sitting at the helm of an organization with more than 8 million loyal borrowers, they worried he could shake up Bangladeshi politics as he shook up microfinance.

Tensions were always present between Hasina and Yunus after that. But recently, in the wake of a Norwegian documentary that painted Grameen in a poor light, Hasina's government seized the opportunity and brought corruption and defamation cases against Yunus. Those actions obviously failed, so we'll see what comes of this "mandatory retirement" approach.

The official stance of the Grameen Bank puts the matter on legal grounds:

Grameen Bank is taking legal advice. It is also examining all the legal aspects of this issue. Grameen Bank has been duly complying with all applicable laws. It has also complied with the law in respect of appointment of the Managing Director. According to the Bank's Legal Advisors, the founder of Grameen Bank, Nobel Laureate Professor Muhammad Yunus, is accordingly continuing in his office.

The real danger with all of this stretches far beyond Grameen. In the process of eliminating an erstwhile political rival, Hasina is sidelining, and potentially permanently handicapping, the key spokesman for microfinance.

All of this comes at a fragile time for the industry. India has taken actions to protect borrowers from predatory microlenders raising serious questions about the effectiveness of microfinance as a tool for fighting poverty. Those are claims Yunus refutes by drawing a distinction between different types of lending and lenders.

That's a debate that should be had, and is happening, but this move by the Bangladeshi government isn't helping sort out the best way to combat poverty.

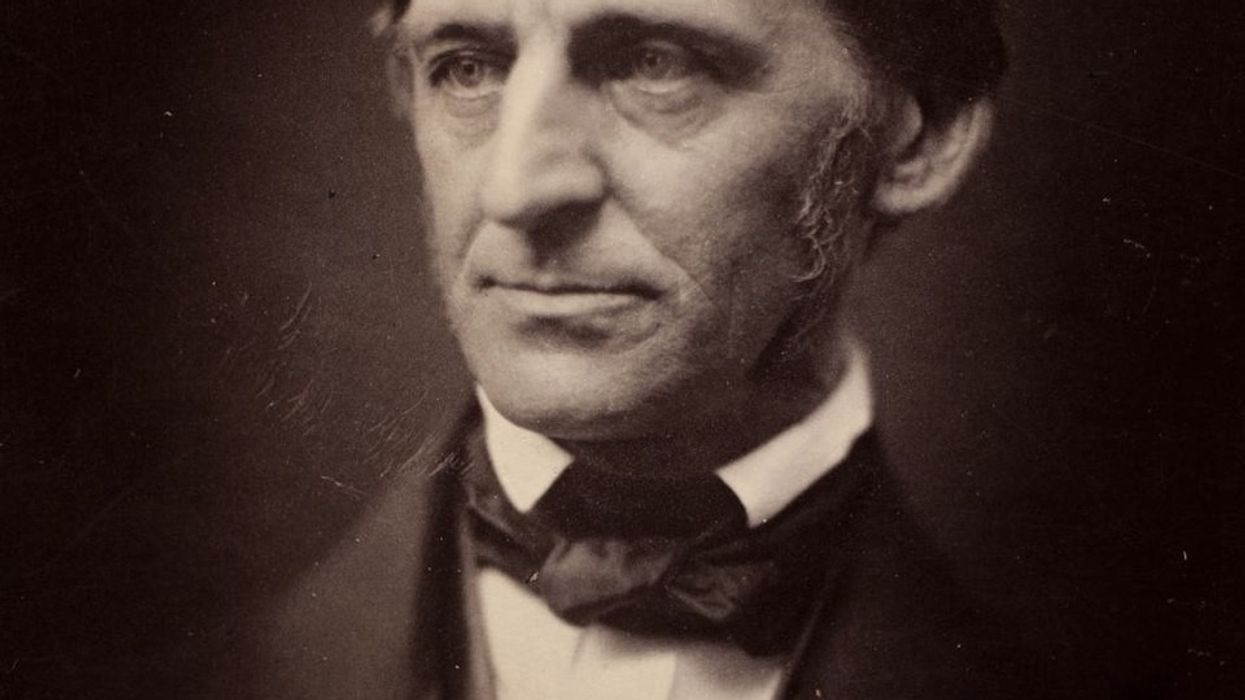

Image: (cc) by World Economic Forum.