As the cost of higher education skyrockets, student loan debt has become an unavoidable rite of passage for most college students. Collectively, Americans owe a whopping $1.45 trillion in student loan debt, which outpaces credit card debt by upward of $600 billion. While many people consider money taken out to obtain a degree to be “good debt,” new numbers from the Department of Education (DOE) show an alarming number of Americans just can’t afford it.

After declining for four years in a row, the number of people who have defaulted on their student loans has risen to 11.5%. Though that number is still lower than it was five years ago when the default rate was 14.7% — thanks to the Obama administration’s aggressive push to offer options like income-based loan payments and its commitment to go after for-profit institutions that saddled students with mountains of debt — the uptick in defaults is not a good sign for the economy. Now, a record 8.5 million Americans are in default on their loans, and that number just keeps growing.

Along with the updated numbers, the DOE also listed 10 colleges whose student loan default rate is over 30%, which could result in a loss of access to federal financial aid funds. Proponents of stricter protections for students argue the DOE’s recent rollback of Obama-era rules aimed at protecting students from predatory for-profit colleges will only lead to even more student defaulting on their loans.

“Now is the time to be improving student loan policies and increasing oversight and accountability,” said Pauline Abernathy, executive vice president of the The Institute for College Access and Success. “But the Department is doing the opposite. The Department’s rollback of critical protections and enforcement will only lead to more student loan defaults, higher debt burdens, and wasted taxpayer dollars.”

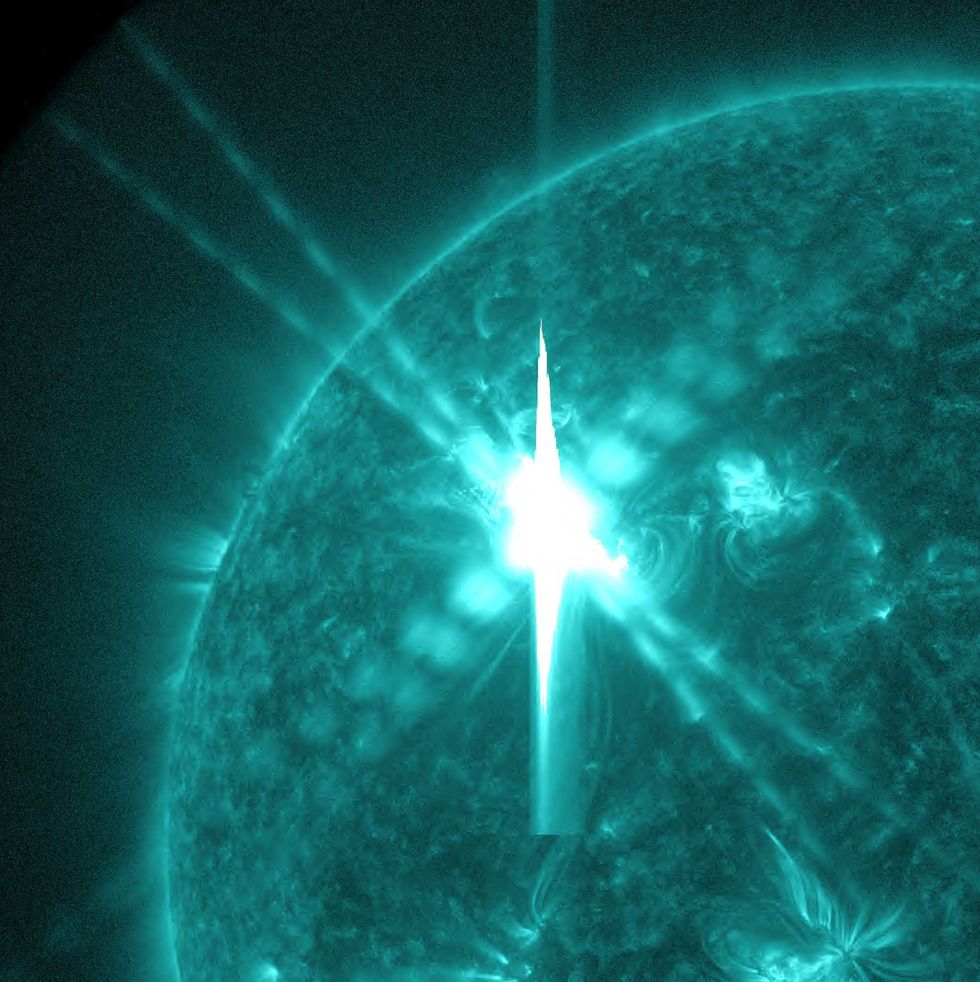

Image artifacts (diffraction spikes and vertical streaks) appearing in a CCD image of a major solar flare due to the excess incident radiation

Image artifacts (diffraction spikes and vertical streaks) appearing in a CCD image of a major solar flare due to the excess incident radiation

Ladder leads out of darkness.Photo credit

Ladder leads out of darkness.Photo credit  Woman's reflection in shadow.Photo credit

Woman's reflection in shadow.Photo credit  Young woman frazzled.Photo credit

Young woman frazzled.Photo credit

A woman looks out on the waterCanva

A woman looks out on the waterCanva A couple sits in uncomfortable silenceCanva

A couple sits in uncomfortable silenceCanva Gif of woman saying "I won't be bound to any man." via

Gif of woman saying "I won't be bound to any man." via  Woman working late at nightCanva

Woman working late at nightCanva Gif of woman saying "Happy. Independent. Feminine." via

Gif of woman saying "Happy. Independent. Feminine." via

Yonaguni Monument, as seen from the south of the formation.

Yonaguni Monument, as seen from the south of the formation.