Since its inception in 2009, GOOD’s social impact consultancy, GOODcorps, has worked with premier brands like Pepsi, Starbucks, DICK’S, PUMA, the Girl Scouts, and more to design iconic programs that engage brand, consumer and cause in creating real action—not just awareness.

“I’ve always been interested in innovation. How do you create a new product that solves a problem in a different way?” she says about her passion for working at GOODcorps. “I really love the overlap of thinking about how to solve a new problem in a way that is also good for humanity.”

But lately, Redin has experienced a disconnect between the way companies and consumers think about social issues, which is why GOODcorps recently embarked on a research study that strives to define what “goodness” means in terms of companies, foundations, and brands. We caught up with Redin as she prepared to share these initial findings at Sustainable Brands, a social awareness-driven business conference, this morning in San Diego.

Talk to me about this GOODcorps study that’s trying to define “goodness” as it relates to companies.

We work in the space where the idea of “goodness” in companies is something that we are asked to highlight. We started to think about what the actual definition of that word was. How do you know if a company is “good?” From the company’s side, the words that usually come out are “sustainability,” “corporate social responsibility,” “citizenship”—words that often have little meaning to consumers. So, what we tried to do was take a step back from that and ask consumers how do they even think about “goodness”? How do they define it? What is the framework for them to decide that a company or a brand or a product is “good” or not? We’ve finished the first of three stages of research.

How are you conducting the study?

First, we’re having conversations with early adopters and emerging leaders in the social impact space. Not only have they been thinking about this for a while, but they’re also consumers, so we thought that would be an interesting place to start.

[quote position="full" is_quote="true"]People are the new ‘green.’ It was fascinating to hear, ‘What is that company doing for its employees?’[/quote]

Can you go a little deeper into some of the things you’ve learned from the research?

One thing is that there’s a disconnect between what people say and what people actually do. There are surveys out there that say things like, “People will pay more for products that are more sustainable.” But at the end of the day, if you look at the marketplace, that actually doesn’t bear out. A lot of these “good” products are not leaders in their categories.

The pattern we saw was one where all the typical drivers still applied: convenience, quality, accessibility, price. All those things were super important, but where “goodness” plays an interesting role is that it was the thing that kept them coming back. For example, one of the people that we interviewed was buying sporting gear. He ended up going to REI and buying products, but it wasn’t until after he finished the purchase that he realized that REI was a cooperative, and very thoughtful about the things that they do. It was that knowledge that happened afterwards that kept him coming back to REI.

So the hypothesis is that after somebody makes a purchase, and they realize that what they’ve done is purchase from a company that has this “goodness” factor, they think, “Okay, I would purchase from this company again”?

Yes. The reason that that’s such a particularly interesting way to think about it is because customer loyalty is highly valued by marketers. So thinking about “goodness” in that perspective has a lot of power, as opposed to thinking that “goodness” is the initial purchase driver. You can’t convince a really busy mom to buy based on the “goodness” of diapers, but if that mom finds out that her diaper purchase is doing something great for our kids or the world, then she thinks, “I’m going to come back to that particular brand.”

One of the interesting things you’re exploring in the study is this idea about how “people are the new ‘green’.” Can you give me an example of a company that deals with this idea well?

Coming from the corporate side, you often hear, “Here’s what the company gives money to,” and, “Here’re the sustainability efforts that we’re doing.” I have to tell you, when we talked to people, we rarely heard them mention that.

It was fascinating to hear, “What is that company doing for its employees?,” and “How are they bettering the community?,” and “Are they being ethical about how they treat their suppliers?” In the past, sustainability has been something that we’ve put a lot of focus on. I don’t think that’s gone away, but I think that there’s been a tremendous increase in awareness that employees and the people around the company are equally important.

Patagonia is a company that keeps on coming up as a really great example. There are people who work there whose passions are aligned with the company’s, which of course in turn makes them create better product. They treat their suppliers well. It’s a very holistic way of thinking about their supply chain and their employees.

Can you talk about the idea of “clarifying for the consumer”?

One of the things that we heard as we were having these conversations was that a consumer needed to really understand the process a product went through to determine whether they’re buying a ‘good’ product or not. There are two categories that are skilled at this: food and clothing. For food, you imagine the farmer, you imagine how the food may get into the truck, how it gets processed, and how it may end up on your table. Same thing with clothing. Everything else is really obscure.

We spoke with a woman who loves tech gadgets, acknowledged there are enormous sourcing issues for metals, but felt the issue was “too big for me to wrap my head around.” We heard similar comments around cars: “Prius is great, but I think there are some issues around batteries that I don’t understand.”

So are people expecting more out of companies that have overly complicated supply chains? Do consumers want companies to be more transparent?

These are all hypotheses, but [those questions are] exactly what we’re looking to find out: Where is that level of transparency? Is it something consumers want? Or is it something they feel comfortable with? I’m not sure consumers are clamoring for it, but once they have it—according to the people we spoke to—they’re able to make better decisions.

What happens with this research? What will be done with it once it's been completed?

The research, for us, is really fundamental. It informs our work and how we help companies. We’re happy to share it with other people. The more we can share our research, and the more companies create social impact that’s sustainable for them as companies, the better off we are.

What are the main hypotheses?

So, as we had these long conversations with people about what that meant, several hypotheses emerged for us. “Goodness” being a loyalty driver; people needing language around “goodness”; leaders playing a surprisingly important role in pushing the issues forward; and how companies treat people is really important.

What will happen next with the study?

The second stage will be surveying people who self-identify as having these values, which will lead to the third phase of the project, a much larger-scale survey with the general public—with people who never think about buying a “good” brand. How do they think about how companies treat employees? It may be that they still care or it may be that they don’t care at all, but we want to understand how far that goes, so we can track those types of issues across multiple years.

So right now, you’re basically refining what the right questions are to ask in the larger survey.

That’s exactly right.

Screenshots of the man talking to the camera and with his momTikTok |

Screenshots of the man talking to the camera and with his momTikTok |  Screenshots of the bakery Image Source: TikTok |

Screenshots of the bakery Image Source: TikTok |

A woman hands out food to a homeless personCanva

A woman hands out food to a homeless personCanva A female artist in her studioCanva

A female artist in her studioCanva A woman smiling in front of her computerCanva

A woman smiling in front of her computerCanva  A woman holds a cup of coffee while looking outside her windowCanva

A woman holds a cup of coffee while looking outside her windowCanva  A woman flexes her bicepCanva

A woman flexes her bicepCanva  A woman cooking in her kitchenCanva

A woman cooking in her kitchenCanva  Two women console each otherCanva

Two women console each otherCanva  Two women talking to each otherCanva

Two women talking to each otherCanva  Two people having a lively conversationCanva

Two people having a lively conversationCanva  Two women embrace in a hugCanva

Two women embrace in a hugCanva

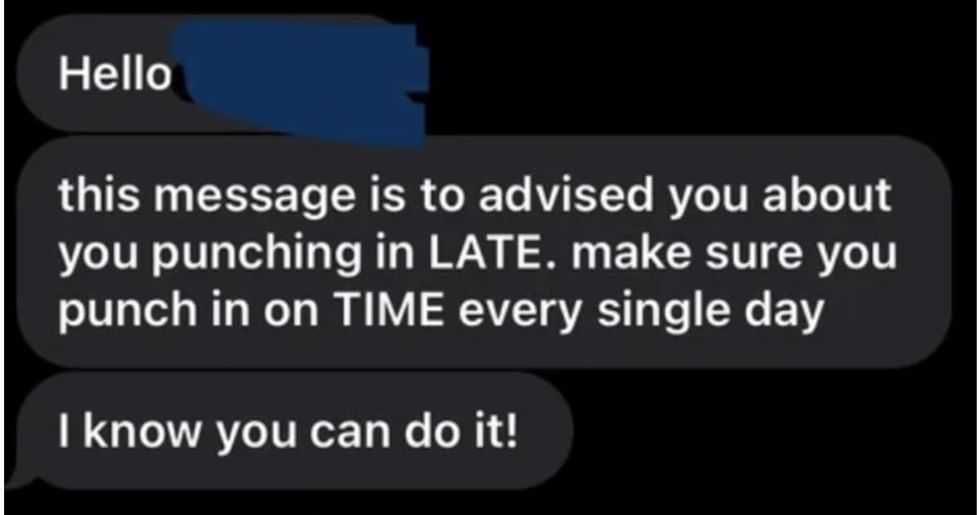

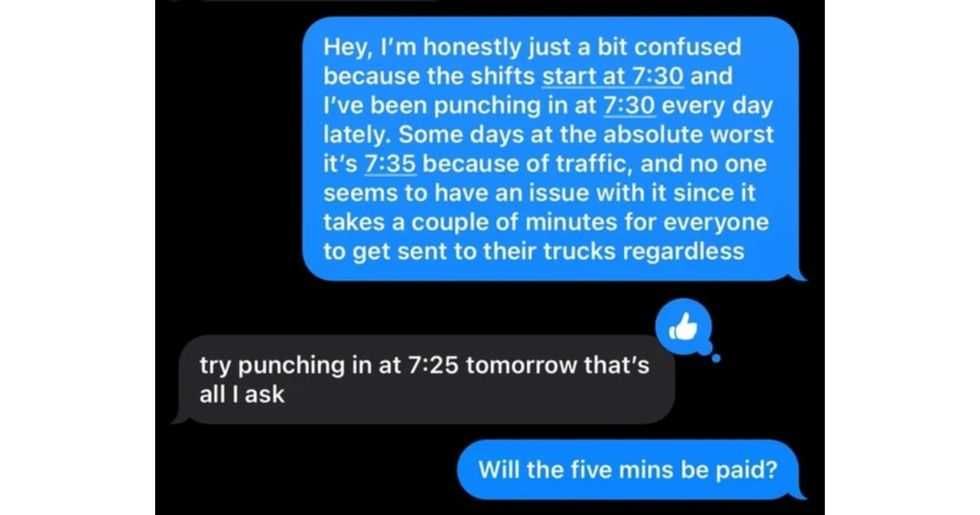

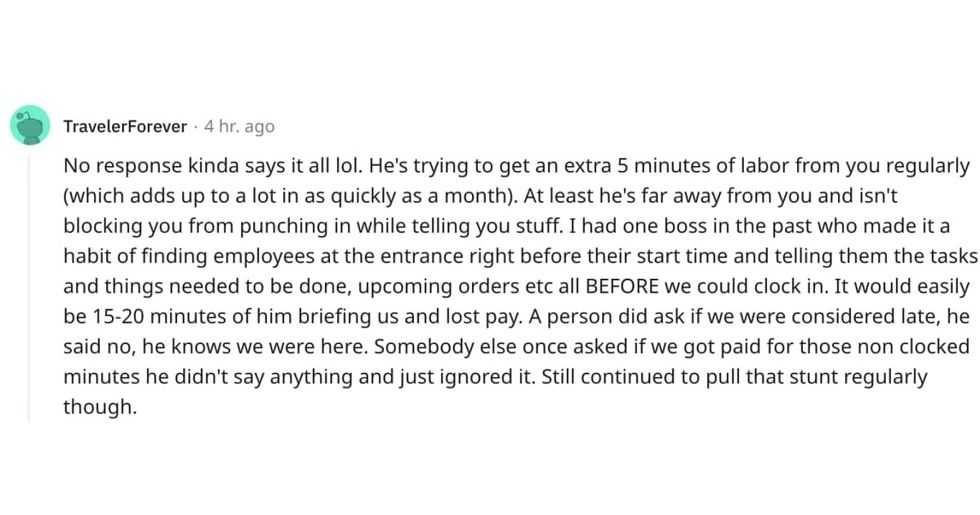

A reddit commentReddit |

A reddit commentReddit |  A Reddit commentReddit |

A Reddit commentReddit |  A Reddit commentReddit |

A Reddit commentReddit |  Stressed-out employee stares at their computerCanva

Stressed-out employee stares at their computerCanva

Who knows what adventures the bottle had before being discovered.

Who knows what adventures the bottle had before being discovered.

Gif of young girl looking at someone suspiciously via

Gif of young girl looking at someone suspiciously via