For decades, there has been article after article regarding Millennials and their income holding them back from various milestones such as paying off student loans, homeownership, and even having children. Now, it appears that not much has changed and Gen Z is feeling the hurt in the wallet as well.

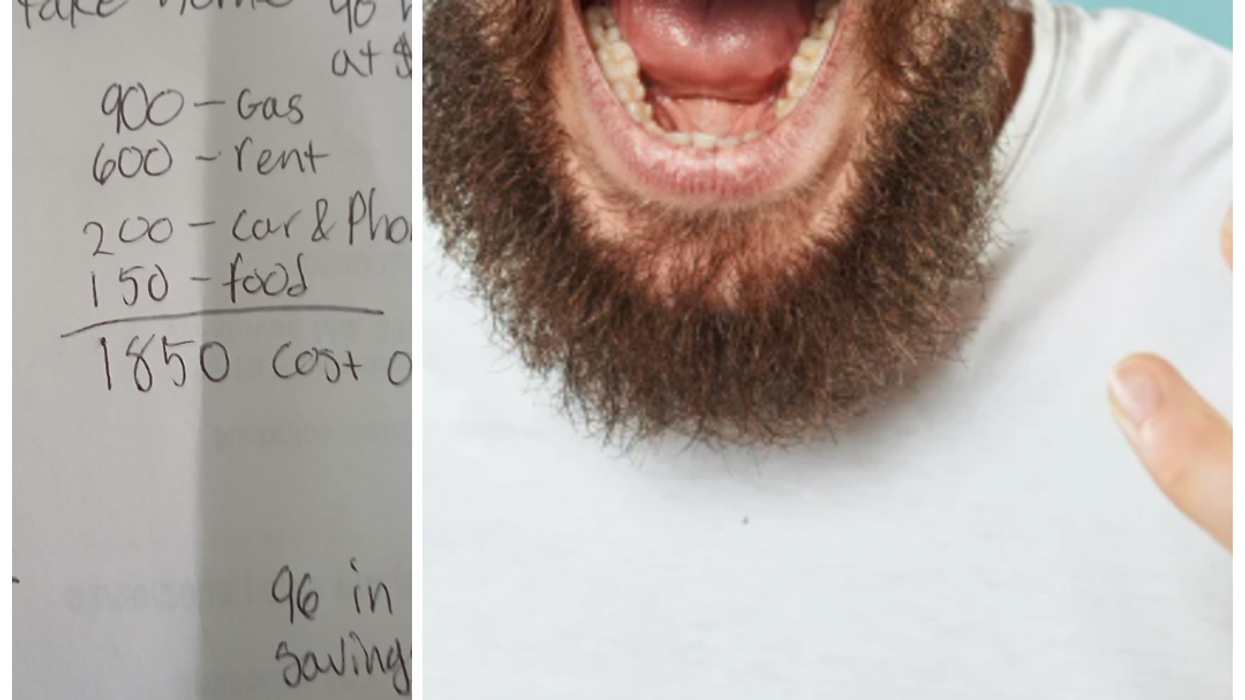

A post on Reddit is making the rounds on the Internet showcasing the budget of a Gen Z worker who is working full time and is still struggling, even though they are living with their parents. After breaking down their monthly earnings with a $16/hour wage, they calculated that after making payments for gas (including fuel for driving his parents and brother around), rent to their parents, food, car payments, and cell phone service, they only take home $96/month in savings. But that little bit of money is one car repair away from disappearing altogether.

The poster continued to share that their parents gave them six months until they had to move out, but that even if they got their raise in four months, it would only be a single dollar per hour more. They also shared that the answer to their problems isn’t “work more hours.”

“I’m showing this to the older generations that say we're lazy and shit, and I don't want to hear anything because I’m not allowed overtime and I work 6 days a week,” they wrote.

Other posters shared their thoughts and struggles.

“How do they expect anyone to live on $16/hr when prices have doubled on almost everything?”

“Some states' minimum wage is still $7.25.”

“Horrible people charging him $600 when he can't even afford to save.”

“Cost of living is obnoxiously high and wages aren’t nearly high enough to balance out how much it costs to live.”

While the poster got some advice regarding finding a place closer to his job, investing in a better vehicle, different budget math, and other ways to help make ends meet, the fact remains that Gen Z is falling into the same financial burden that Millennials have long fallen into.

To put things into perspective, the national minimum wage, currently standing at $7.25/hour, was last changed in 2009, back when the oldest Gen Zers were 12 years old. While some states have raised their minimum wage, the lion’s share haven’t raised wages or their raises still wouldn’t make enough difference to help their residents make a living.

Here are some examples using the Massachusetts Institute of Technology (MIT) living wage calculator. Iowa, which has the national limit for minimum wage at $7.25/hour, would require a single person with no kids to make $20.89/hour as a livable wage. Even if you lived in Washington, D.C. which has the highest minimum wage at $17.50/hour, it would require a single person with no kids $25.98 to make ends meet. It should be stressed that those are for folks that live alone without kids, as the cost of living would be even greater should you and your partner have children.

It should also be noted and stressed that the minimum wage was established to help adult workers obtain “purchasing power” for the overall economy, not as a “starter wage” for teenagers and others who are just entering the work force. Its intention was to protect all workers from exploitation from their employers. As the Reddit poster and MIT shows, even $16/hour doesn’t provide much for the modern worker.

As Millennials and Gen Z get older, solidarity will hopefully form and bring about change that will benefit both generations through collective action, changes in economic policy, and life overall.

This article originally appeared in March.