Michael Sheen is known to most folks for his acting roles in Good Omens, Masters of Sex, and the Twilight film franchise, but to 900 people he’s the guy who paid off their loans. Through his work and £100,000 ($129,000) of his own money, Sheen has written off £1 million ($1.29 million) of their debt.

Highlighted in his upcoming Channel 4 documentary, Michael Sheen’s Secret Million Pound Giveaway, is Sheen’s debt acquisition company that he funded for his home community in south Wales. This comes shortly after he declared in 2021 that he was a “not-for-profit actor," pledging to use his paychecks from acting gigs to fund different projects such as this and the Welsh National Theatre. Sheen's debt acquisition company is like many others in that it purchased the debts of those people for pennies on the dollar. However, unlike several debt acquisition companies, Sheen didn't pursue the debtors to pay off their original debt for a profit.

Sheen’s documentary hopes to highlight how finance companies and banks take advantage of the most vulnerable and profit from them, a growing issue in Wales and other countries, including the United States.

“The shocking thing is that people have started having to use credit cards, overdrafts to pay for basics, to pay for necessities, rather than luxuries or anything like that, so the debt that I was able to buy included credit card debt, overdrafts, car finance, that kind of stuff,” Sheen said to The Hollywood Reporter.

Sheen also remarked about how difficult most financial institutions make it for regular people to pay off their debt once it has accrued. “People are getting into spirals of debt,” he says. “Once you’re underwater it’s very hard to get out again. That’s why I wanted to do this — to draw attention to the fact that this is going on, and there is a way to change it, there are alternatives, and we need to push to try and make a difference for people.”

Sheen may have a point. According to a 2024 Q4 analysis from the Federal Reserve Bank of New York, household debt in the U.S. rose by $94 billion in the last three months of 2024, leading to a total of $18.04 trillion. The reasons behind this are numerous, ranging from high interest rates preventing debt premiums from being paid off, cost of living rising, and people being forced to use credit because they have no savings among others. Meanwhile, banks in the U.S. gained $268.2 billion in profits in 2024, with a 5.6% boost occurring the same time as household debt increased by $94 billion.

Unfortunately, it’s unlikely that Michael Sheen will be able to personally pay off everyone’s debt, so we’ll have to explore other options. In terms of getting out of your own personal debt, there are many different theories, tactics, and services out there willing to lend you a hand (or allow you to help yourself). The Federal Trade Commission offers some viable solutions.

In terms of the systematic problems, there are again several theories and proposals posited to the government to provide debt relief to everyday people whether it is through stimulus checks, tax cuts, or regulations to our financial institutions. If this is something that matters to you, investigate local activist groups or candidates that are pushing for the change you wish to see in debt relief, banking, or other whatever could solve this growing problem.

While it was very kind of Sheen to extend a hand to 900 people, it will require much more of us to extend a hand to so many more to ensure a better life for everybody.

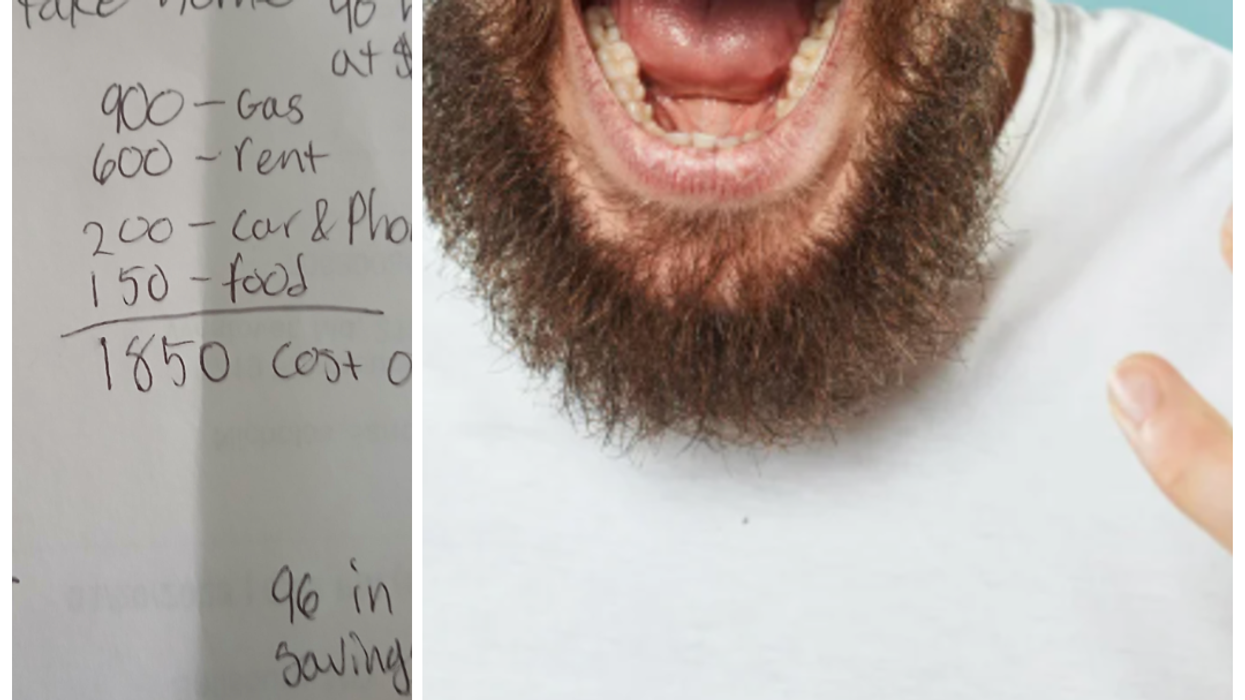

Take home pay is becoming less and less as expenses rise year after year.Photo credit: Canva

Take home pay is becoming less and less as expenses rise year after year.Photo credit: Canva Making bill payments gets harder each year.Photo credit: Canva

Making bill payments gets harder each year.Photo credit: Canva

Representative Image Source: Pexels | Olly

Representative Image Source: Pexels | Olly Representative Image Source: Pexels | Pixabay

Representative Image Source: Pexels | Pixabay Representative Image Source: Pexels | Cottonbro

Representative Image Source: Pexels | Cottonbro Representative Image Source: Pexels | Cottonbro

Representative Image Source: Pexels | Cottonbro Representative Image Source: Pexels | Karolina Grabowska

Representative Image Source: Pexels | Karolina Grabowska Representative Image Source: Pexels | Jonathan Borba

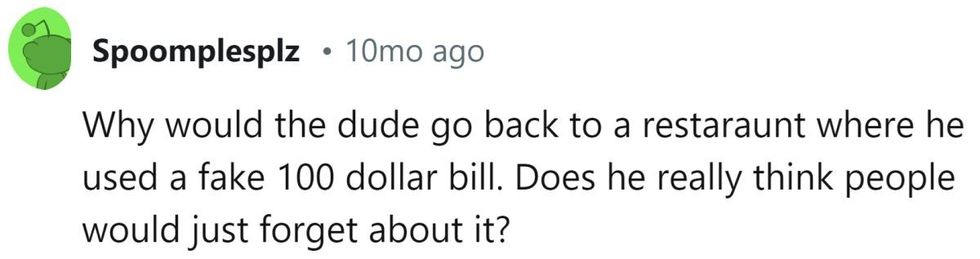

Representative Image Source: Pexels | Jonathan Borba Image Source: Reddit |

Image Source: Reddit |  Image Source: Reddit |

Image Source: Reddit |  Image Source: Reddit |

Image Source: Reddit |

Representative Image Source: Pexels | Pixabay

Representative Image Source: Pexels | Pixabay Representative Image Source: Pexels | Pixabay

Representative Image Source: Pexels | Pixabay Representative Image Source: Pexels | markus winkler

Representative Image Source: Pexels | markus winkler

Representative Image Source: Pexels | Shvets Production

Representative Image Source: Pexels | Shvets Production Representative Image Source: Pexels | Oleksandr P

Representative Image Source: Pexels | Oleksandr P Representative Image Source: Pexels | Photo by Spencer Selover

Representative Image Source: Pexels | Photo by Spencer Selover Representative Image Source: Pexels | JSME Mila

Representative Image Source: Pexels | JSME Mila