Even if you like your job, you’re likely to find yourself daydreaming about not being there as you sit in your cubicle attaching the proper cover sheets to your TPS reports. In between stapling, you’ll steal glances at Instagram, where friends can be seen lounging on beaches, traversing verdant mountains, or strolling the Champs Elysee and start planning your next escape from the daily grind. What you may not be doing in that moment is actually planning how to pay for that trip ahead of time.

Americans are more than willing to go beyond their means for the opportunity to get away. Nearly 75% of the country has gone into the red to take a vacation while absorbing $1,108 of debt on average, according to a study conducted by the financial planning site LearnVest, which surveyed 1,000 adults to better understand their vacation-related spending and saving habits.

The survey points to millennials being the worst offenders, reporting that 49% of them are willing to go into debt to finance their getaway as opposed to 37% of Gen Xers and 18% of Baby Boomers. And while Americans spend an average of 10% of their annual incomes on vacations, 38% of millennials spend more than 15% of their annual income.

Of course, this fits with the predetermined narrative of shiftless millennials wanting to constantly live their best lives instead of work. Or it could point to that fact that because they’re the youngest cohort of the workforce, and thus any sort of vacation consumes a larger portion of their lesser income.

However, while we’re not going to fall for the “those damned irresponsible kids!” trap usually associated with a study like this, the stat about the willingness to take on debt is a troubling fact worth talking about.

It’s really tempting to hop on that vacation deal when it happens. “Only $350 to fly to Iceland! I’d be losing money if I didn’t do that!” is what the airline and hotel companies vying for your business hope you’ll exclaim as you click on the banner ad and pull out your credit card. There’s nothing wrong with holding out and waiting for a deal, but you should build a cushion in your budget so it can absorb the cost of jumping on a great deal instead of putting it all on plastic.

This is so important because unless you plan to just charge yourself into oblivion and declare bankruptcy (which, we obviously don’t recommend), you’re going to pay for this trip in the end anyway. Let’s take that $1,108 figure from the study. If you pile on that much debt for a vacation and only pay back the minimum amount each month ($25 is pretty common), assuming your card has the industry average APR of 13.57%, then it will take you a little more than five years to pay off that trip. And, along the way, you’ll accrue $438 in interest payments on the debt. That’s enough to pay for another insanely cheap flight to Iceland!

So we’re definitely not the killjoys telling you to not go on vacation. Spend your time and money how you like. However, you should rethink your willingness to take on debt to do it. You’ll be able to afford more vacations down the line if you heed this little bit of advice.

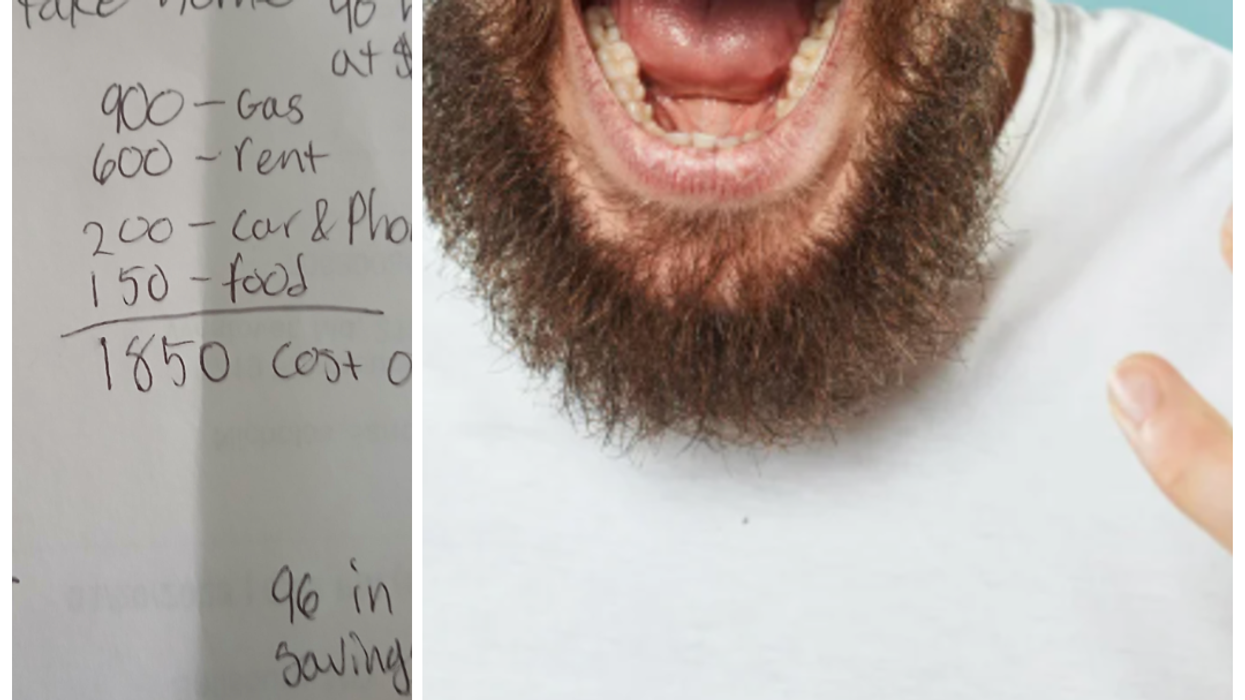

Take home pay is becoming less and less as expenses rise year after year.Photo credit: Canva

Take home pay is becoming less and less as expenses rise year after year.Photo credit: Canva Making bill payments gets harder each year.Photo credit: Canva

Making bill payments gets harder each year.Photo credit: Canva

Representative Image Source: Pexels | Olly

Representative Image Source: Pexels | Olly Representative Image Source: Pexels | Pixabay

Representative Image Source: Pexels | Pixabay Representative Image Source: Pexels | Cottonbro

Representative Image Source: Pexels | Cottonbro Representative Image Source: Pexels | Cottonbro

Representative Image Source: Pexels | Cottonbro Representative Image Source: Pexels | Karolina Grabowska

Representative Image Source: Pexels | Karolina Grabowska Representative Image Source: Pexels | Jonathan Borba

Representative Image Source: Pexels | Jonathan Borba Image Source: Reddit |

Image Source: Reddit |  Image Source: Reddit |

Image Source: Reddit |  Image Source: Reddit |

Image Source: Reddit |

Representative Image Source: Pexels | Pixabay

Representative Image Source: Pexels | Pixabay Representative Image Source: Pexels | Pixabay

Representative Image Source: Pexels | Pixabay Representative Image Source: Pexels | markus winkler

Representative Image Source: Pexels | markus winkler

Representative Image Source: Pexels | Shvets Production

Representative Image Source: Pexels | Shvets Production Representative Image Source: Pexels | Oleksandr P

Representative Image Source: Pexels | Oleksandr P Representative Image Source: Pexels | Photo by Spencer Selover

Representative Image Source: Pexels | Photo by Spencer Selover Representative Image Source: Pexels | JSME Mila

Representative Image Source: Pexels | JSME Mila