Traditionally, married couples are expected to merge their finances after saying “I do.” But that tradition is becoming more and more outdated. In a 2014 U.S. survey of 1,000 married couples and co-habitating partners conducted by TD Bank, 42 percent them had both joint and separate bank accounts.

The survey also revealed that women are especially interested in maintaining separate accounts. Forty-three percent of the women surveyed said independence was the primary reason they wanted separate accounts. For men, independence is a factor (38 percent cited it as motivation to keep accounts separate), but the same percentage of men said they also favored the convenience of separate accounts.

For some couples, it works best not to have any joint accounts, with nary an official penny shared between them. I spoke with three women who explained why keeping their finances separate from their partners’ serves both their needs, and ultimately leads to a balanced and empowering relationship.

Alyssa Tucker, 28, and Theo Hysell, 30, have been dating for five years, and have been living together for three and a half years.

Why have you decided to keep your accounts separate?

Alyssa Tucker: Theo feels very passionately about keeping his money separate still. Right now, we have no immediate need to do things differently. We've had different financial journeys in our adult lives and have different debt-to-income ratios. We both have worked hard to be in better places financially and improve our credit scores.

How do the two of you handle expenses?

We each pay separate bills (Theo pays gas and internet, I pay for the electric bill). I pay him for my portion of the phone bill. At the grocery store we try to divide the bill in half at the register so that neither of us “owe" the other a chunk of money.

Overall, how do you make your finances work on a monthly basis?

We try to take turns paying for things. It may not be exactly 50-50 but it seems to work for us.

If there is a larger expense, we try to acknowledge that, and either send each other money through a payment app, or make sure the other person pays for the next thing. We try not to make a big deal if it doesn't happen perfectly, because there's always another expense.

How does having separate finances impact your relationship? Do you have any trust issues as result?

Theo came from a relationship where there were a lot of trust issues as a result of money. Having come from a bad money relationship, it took him some time get used to being treated respectfully in regards to finances.Now that his income is increasing faster than mine, he has become more willing to take on a larger portion of some financial responsibility and no longer has any reservations about it.

Do you think it would be easier to have a shared account?

I would still one day like to have a shared account to save for traveling. I think it would be helpful to grow that fund together since saving money can be hard in general. Knowing that it is "fun money" to have a shared experience together makes the idea a little easier for Theo to get behind. I'd say we're like 60 percent there, but with separate banking institutions, there are still some logistics to get past.

We’re very open and transparent about our current finances. We are good at problem solving, and continue to brainstorm what our financial future looks like together. I think when we're closer to buying a house together, the idea of creating a shared account will come up more seriously.

Do you think you'll ever merge your finances entirely?

I have a hard time imagining a future in which we'd combine all funds. I know Theo has heard some "horror" stories about shared finances between significant others. I think we've done a pretty awesome job at not letting money issues impact our personal relationship and I hope to keep it that way.

Jagger Blaec, 30, and Cornelius Trump, 34, have been married for six months (after being engaged for four years and dating for three years prior).

How do the two of you handle expenses?

Jagger Blaec: We kind of just split things down the middle. I make him pay more in rent because I am in charge of all the food and household needs. He manages all the car stuff and utilities and pays the dog walker. We each pay our own cell phone bills, and since I don’t have any debt from student loans, I am helping him pay his off faster.

Overall, how do you make your finances work on a monthly basis?

Since we're both currently employed, it goes pretty smoothly. When you don’t have kids, there's not that much to manage prior to becoming a homeowner.

How does having separate finances impact your relationship?

I think it keeps everyone sane. I like to shop a lot and buy whatever I want, and I think he also enjoys having that freedom.

Do you have any trust issues as a result?

I trust him more to manage his own finances and know he's responsible enough to have his bills covered. I don’t really care what he does with the rest.

Do you think it would be easier to have a shared account?

Absolutely not. I think I mentioned a spending habit above. And I think it's a lot easier to spend someone else's money, and I know I lack certain levels of control in that respect.

Do you think you'll ever merge your finances?

Maybe. We're still newlyweds and haven't gotten to the babies and house phase of life just yet. From what I have heard, babies and children require a lot of time and money. We're still enjoying each other and the ability to be financially spontaneous, so a merger is a possibility when we're ready to get to that next chapter of life.

Why have you decided to keep your accounts separate?

It wasn't really a decision. We've been living together for six years and have always done things this way so it's kind of a hassle to switch it up for no real reason. Also, my sister is an attorney and said that women should manage their own finances as a way to remain independent, just in case life doesn't go as planned. And I totally agree with that.

Erin Kelly, 28. She has been living with her partner, who is the same age as she, for about six years.

How do the two of you handle expenses?

Erin Kelly: We don't have strict guidelines, but, mostly, he pays all the recurring bills that we need, such as the mortgage, power, phone bill, and so on. I pay for expenses that come up, like groceries, social events, gifts, and things for the house. I pay the bills sometimes, usually if money is a bit tight for him.

Overall, how do you make your finances "work”?

He used to make a lot more than me, so it didn't make sense for me to try to pay half the bills. As my income went up, it was easy for me to just start helping more wherever I could, and leave the bills in his name. Whatever extra we have left goes into our savings accounts.

How does having separate finances impact your relationship? Do you have any trust issues as a result?

I don't think trust issues with money are a problem if you don't already have trust issues in your relationship. Neither of us is irresponsible with our spending, and we discuss any big purchases with each other. I think it is more about respect and honesty in general, and not having a need to control each other. If I couldn't trust him to have his own bank account, then I wouldn't be living with him.

Do you think it would be easier to have a shared account?

I don't think it would change anything. At this point, our bills are paid and we can buy what we need. Plus, at least this way, I can still surprise him with presents.

Do you think you'll ever merge your finances?

Sure, when our incomes and expenses change to a point that it is more convenient. Until then, this works fine.

Why have you decided to keep your accounts separate?

We didn't have any reason to combine them. We discussed it, and agreed that we'd combine them when our income and expenses got to a point where it was easier to have one account. We just haven't gotten there yet.

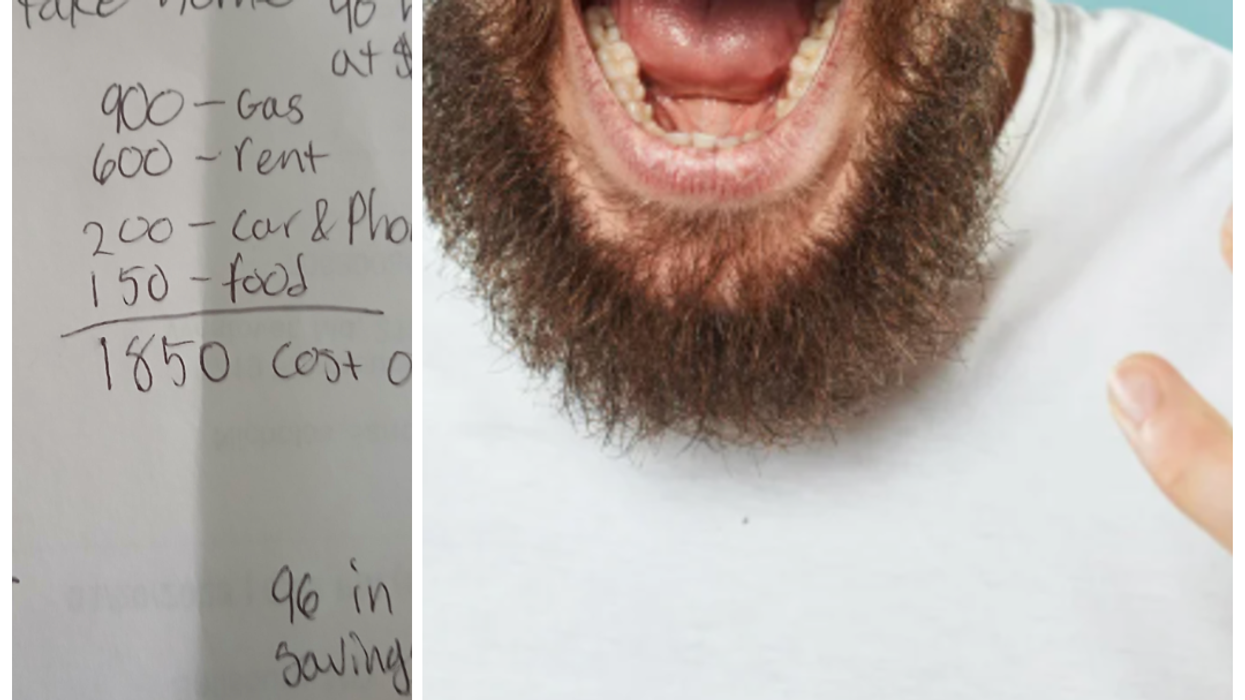

Take home pay is becoming less and less as expenses rise year after year.Photo credit: Canva

Take home pay is becoming less and less as expenses rise year after year.Photo credit: Canva Making bill payments gets harder each year.Photo credit: Canva

Making bill payments gets harder each year.Photo credit: Canva

Representative Image Source: Pexels | Olly

Representative Image Source: Pexels | Olly Representative Image Source: Pexels | Pixabay

Representative Image Source: Pexels | Pixabay Representative Image Source: Pexels | Cottonbro

Representative Image Source: Pexels | Cottonbro Representative Image Source: Pexels | Cottonbro

Representative Image Source: Pexels | Cottonbro Representative Image Source: Pexels | Karolina Grabowska

Representative Image Source: Pexels | Karolina Grabowska Representative Image Source: Pexels | Jonathan Borba

Representative Image Source: Pexels | Jonathan Borba Image Source: Reddit |

Image Source: Reddit |  Image Source: Reddit |

Image Source: Reddit |  Image Source: Reddit |

Image Source: Reddit |

Representative Image Source: Pexels | Pixabay

Representative Image Source: Pexels | Pixabay Representative Image Source: Pexels | Pixabay

Representative Image Source: Pexels | Pixabay Representative Image Source: Pexels | markus winkler

Representative Image Source: Pexels | markus winkler

Representative Image Source: Pexels | Shvets Production

Representative Image Source: Pexels | Shvets Production Representative Image Source: Pexels | Oleksandr P

Representative Image Source: Pexels | Oleksandr P Representative Image Source: Pexels | Photo by Spencer Selover

Representative Image Source: Pexels | Photo by Spencer Selover Representative Image Source: Pexels | JSME Mila

Representative Image Source: Pexels | JSME Mila