I recently bought a car for my 30th birthday. I went to a dealership, signed a stack of loan papers, and drove away with a vehicle that was released within the last decade and has a back-up camera and easily pairs to my phone.

This was new for me. The other three cars I’ve owned were purchased in cash, with deeds of sale scribbled on the backs of old receipts for replaced coolant hoses.

At the dealership, I proudly told the salesperson that I had really good credit and a substantial down payment and that I would not need a cosigner. I think he had doubts about my stability, given my youthful face. Nevertheless, I was a viable — even desirable — candidate for ownership. And I was proud of it. After more than a decade of financial independence, I was finally able to purchase something big all on my own.

[quote position="full" is_quote="true"]None of us are really all on our own when it comes to money.[/quote]

In spite of the fact that I’ve paid all of my own bills for close to a decade, I am far from true financial independence — and you probably are, too.

In talking to my friends and acquaintances about this term “financial independence,” it became clear to me that there actually is no such thing. None of us are really all on our own when it comes to money; yet some forms of dependence are prized while others are condemned.

Kate Asson, who teaches personal finance courses, describes financial independence as “being fully self-reliant. The income you use to meet your expenses is driven by you and you alone.”

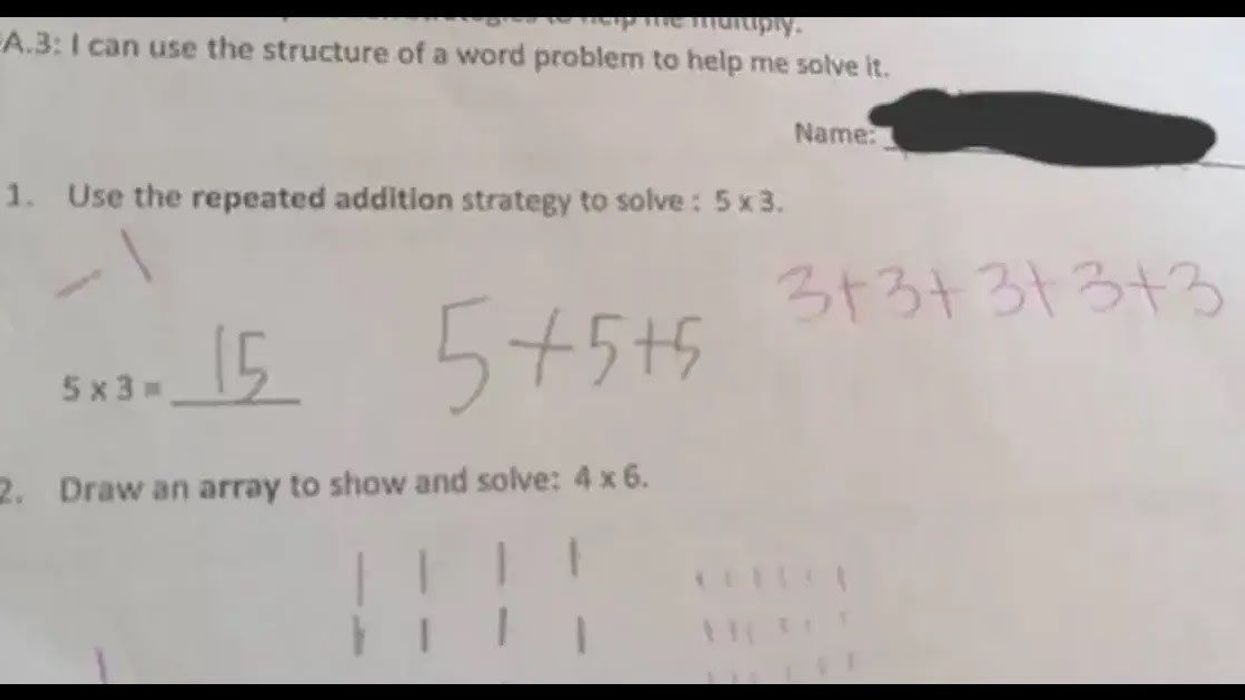

A lot of young people do, in fact, meet that criteria, both anecdotally and statistically. An informal poll among people I know ranging from age 25 to 60 (but heavily skewed around 30) found that most pay their own rent or mortgage, though they do tend to share small accounts between friends or family regardless of age. I would call this prevalent phenomenon not independence, but financial “codependence” — and it happens primarily out of convenience.

Family cellphone plans (personal plans are around $100; on a shared set of lines, they’re as low as $30), shared Netflix accounts (about $10 per month), and Amazon Prime logins ($99 per year) are the most common. Though only about 10% of Americans share an entertainment login of some sort, a full two-thirds of Netflix users say they share their credentials. In many cases, that’s the only shared bill, and it happens because it’s just “easier” that way.

“I'm about to be debt-free in six months,” says 28-year-old Alison Luhrs, who works for Wizards of the Coast (the people who make Magic cards). She’s been steadily paying off her own debt for years and adds that “the only bills I share are a phone plan with my family and a Netflix account with my ex (he pays for Netflix, I pay for Hulu, we share passwords and separate viewer tabs).”

More than half of millennials get no financial assistance from parents, but among those who do, phone bills are the most common form of assistance. That’s not solely out of young laziness, though; one survey found that 51% of parents with adult children on their plan were doing it because the arrangement was cheaper for everyone involved, not just the kids.

One photographer friend, for example, told me he could afford to get off his mom’s phone plan — which saves them both money — but instead, he asks that the payment of his phone bill be considered his birthday and holiday gift each year.

“I'm 33,” he tells me. “I don't need some little trinket. A working phone and data plan is fair.”

These kinds of swapping arrangements are common; they help disperse some of the costs of living, strike a balance between parties, and offer convenience as much as savings. And in the grand scheme of things, those small shared expenses pale in comparison to what millennials are up against, financially speaking. Like debt. Like increased housing costs. Like depressed wages. Like economic factors that previous generations could never imagine.

One couple — each works full-time, and they are solidly middle class and in their mid-30s — live in a suburb that’s convenient for the husband’s job but has extremely limited public school options for their two kids, one who’s in pre-kindergarten and the other in elementary school. As a result, their children attend a private school that costs more than a year of income on minimum wage — which the wife’s parents help pay for.

They could sustain themselves without that help, she told me, but it would force a lot of difficult choices. They’d likely have to move closer to public schools, where they would pay more in rent for less space. Both of the parents would have to spend even more time commuting, which means less time with the kids and more money on fuel. She told me — like many other people I spoke with — that it’s not that they are dependent, but rather that their quality of life is.

[quote position="full" is_quote="true"]For as long as there have been humans, there have been family units that supported each other.[/quote]

Though we attach monumental amounts of pride to financial independence — when I queried for stories, a few people (all men, all Boomers, all white) quipped that they had always paid their own bills — capitalism as it exists in the United States favors those with personal relationships who can draw upon them. Parents and their adult children. Siblings. Friends who secure lucrative contracts for friends in a professional setting, who give raises to their favorite employees but perhaps not their most qualified. And of course, spouses.

There has been no shortage of finger-wagging articles about millennials who choose to move back home, but there are just as many that judge them for not being able to hack it on their own. There is a stigma attached to accepting help, but there’s also a stigma attached to not having help to accept.

Several of the people I interviewed in Seattle had received a much larger investment from a relative in the form of a down payment on a house. In a rental market where the average home price is well out of reach for the average millennial (the average home price is over $700,000; the average millennial earns under $36,000 per year, which is 20% less than the average Boomer earned at the same age) and where rents are increasing much more quickly than income, young adults are forced with tough choices: Stay in the city and sweat it out over rent, move somewhere less expensive (and lose your job or spend hours commuting), or take help from a family member.

For millennials whose parents have a bit of wealth — which, frequently, came from a previous generation who also had wealth — even the idea of a financial safety net feels a little bit like dependence, even if they’ve never taken a dime from their parents or shared bills.

“I always wonder if I would be better with my money, if in the back of my mind I didn't know that my family would totally have my back in an emergency,” said Brian Edwards, 30, who works at a prominent Seattle-area coffee roaster. “I am ‘financially independent,’ but I kind of feel like I don't take retirement-credit-savings as seriously as I should.”

For as long as there have been humans, there have been family units that supported each other. It’s simply the best way to ensure success; we thrive collectively. Partners, family members, and even friends create the network that we rely upon.

[quote position="full" is_quote="true"]Financial independence, in many ways, is a moralized creation rather than a fiscal reality.[/quote]

The feeling of safety — that you could take a dream nonprofit job with a terrible salary, a gap year, or even just a couple of weeks to breathe some time — is a kind of dependence in and of itself. For those who are completely self-supporting and without a potential life raft, the calculation is very different.

Emily, who’s an artist, explained what it’s like not to have the safety net. “If there has been a time where I couldn't pay a bill on time (and trust me, it has happened), I call the company I owe money to and ask how I can make this work; I don't call my parents,” she noted. “I have learned that sometimes you have to work double shifts and 50 hours a week to pay all your bills and expenses on time because for a lot of us, that is the only option. The other option is losing your house, losing your car.”

Much of financial independence comes down to options — the option to borrow from someone, the option to spend outside your means, the option to go back to school or try a new career or move across the country. People without potential financial backing — those with poor credit who can’t get a loan or those with poor parents who can’t help them out — are also people without options.

In the same way that wealth begets wealth, options beget options. When we talk about financial independence, government grants and tax credits don’t typically come up; the conversation is largely focused around phone plans and car insurance.

But true financial independence indicates that a person is able to fully support themselves without assistance — and tax credits (like the estate tax), farm and manufacturing subsidies, and grants like those awarded to student borrowers, homeowners, and businesses certainly afford people options they wouldn’t have otherwise. It’s what businesses and lobbyists and the super-wealthy argue over all the time when government entities threaten to close tax loopholes: We couldn’t operate without them.

Which means that collectively, we’re perfectly fine with businesses and people who already have money being financially dependent on the government or each other, but we’ve decided that other kinds of financial dependence — like a shared Netflix login or help with the rent in a ballooning market — is somehow the mark of lacking moral fortitude.

Financial independence, in many ways, is a moralized creation rather than a fiscal reality.

“There is absolutely nothing wrong with asking for help from your loved ones in times of need; that actually shows so much maturity and is very hard to do for those of us that are very proud,” says Emily. “But it is another thing to expect and depend on other people — besides your partner, boyfriend, husband, wife, whatever — to make your life work financially.”

That is a key difference that we often fail to make. Financial independence (let’s be honest, financial interdependence) in all forms are piled together in the same heap. But there’s a wide expanse between needing and wanting, between accepting and expecting — and it seems to be the line we draw in our heads most often. But it’s a somewhat arbitrary line.

The economic world is in many ways neither designed for nor amenable to individuals. We tend to see financial independence as the ultimate prize: Several people I spoke to say they take pride in their independence, in spite of the fact that it may leave them in financial dire straits. Yet, in a lot of ways, no one is truly financially independent. Or if they are, they’ve most definitely made uncomfortable, difficult, and even detrimental choices.

If you can get by all on your own but your life would be more fruitful if you accepted just a bit of help or partnership, you’re not really dependent. You’re just making choices based on the resources at hand.

Because money, of course, affords much more than just streaming video services and cellphones. It affords time to use those things as well as time for anything else.

[quote position="full" is_quote="true"] Financial independence is really more of a state of mind rather than a state of affairs.[/quote]

There’s a kind of force-multiplying effect to the pride we encourage people without means to take; those living in the daily grind of poverty are told to aim for independence, even when it might not actually be the best thing for them. Take Justin, a middle-aged homeless man I once interviewed, for example. He was a chronic alcoholic and would readily admit it, but when I asked why he didn’t enter a public health detox center, he told me he “didn’t want a handout.”

Meanwhile, society encourages people with means to follow their hearts, not the money. Which is easy to say when you have the money.

In this way, financial independence is really more of a state of mind rather than a state of affairs. Few of us are truly independent — regardless of generation and regardless of income level — and in a lot of real, economic ways, that should be perfectly fine. Borrowing is not implicitly bad. Saving money on family phone plans or splitting rent or going in on a shared Costco membership is not implicitly bad. Sharing a Netflix login is not implicitly bad.

Whether it’s a Netflix account or a mortgage, sharing assets is less about being unable to hack it and more about finding the best possible way to get what you want, what you need, and what you can from a system that has set a lot of people up to fail.