Go to a grocery store in the U.S. and you’ll likely find a small area of the produce section marked “organic,” where the options are pricey and scant compared to the “regular” AKA conventionally produced section. Now, go to India, and you’ll find an entire state growing only organic produce. That’s right: every farm, every field, every vegetable.

Home to more organic farmers than any other country in the world, India now boasts the first state to receive 100 percent organic certification. Small but mighty, all 75,000 hectares of farmland in Sikkim and its 66,000 farmers have sworn off GMOs, pesticides, and chemical fertilizers.

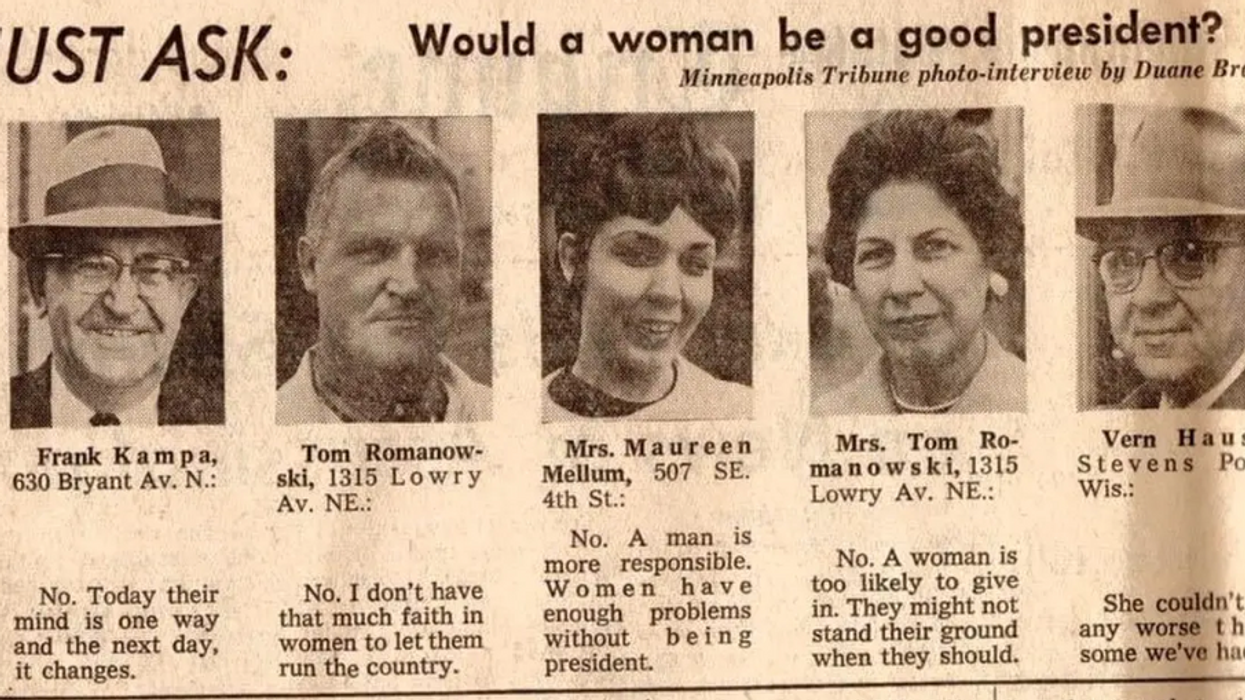

This would be an amazing feat in any U.S. state, where consumers are already willing to pay a premium for organic produce, data from the USDA shows. But in India, the concept of organic certification is still pretty new and has yet to gain strong consumer support.

“Going fully organic was a massive milestone,” Food Radio Project’s Amrita Gupta reports. “But now Sikkim has to learn how to market that produce, and as they do, the rest of India is learning right along with them.”

[quote position="full" is_quote="false"]India's restrictions would have cost Monsanto millions of dollars worth of lost profits each year. [/quote]

Growing crops with little to no inputs and using reproductive seeds dates back centuries in India, but the added value of an organic label is proving to be a learning curve for its consumers. Sikkim is a living case study for the Indian government, and its success or failure will prove whether or not statewide organic production is reproducable in larger states.

The milestone of going fully organic comes thirteen years after the Sikkim Organic Mission set forth its Action Plan of 2003, through which it has gradually removed subsidies for chemical fertilizers and pesticides, increased the integration of organic farming resources, and purchased organic certification for Sikkim’s farmers, saving them 33,000 rupees each (or approximately $495).

The farmers in Sikkim are mostly small-scale, subsistence farmers whose plots average four hectares or less, where the landscape is hilly—neither ideal for the large-scale monocropping of conventional agriculture. Though labor-intensive, much of organic agriculture is cost-effective: farmers don’t need expensive GMO seeds nor the synthetic inputs they require. The annual expense of certification is often their biggest hurdle, along with the risks of entering a new field (quite literally).

In the U.S., the cost of organic certification varies, but averages $1,000. The USDA’s cost-share program covers up to $750 of farmers’ expenses, but yearly dues to maintain certification and fund inspections must be paid in order to remain organic. It’s unclear if, or for how long, the Indian government will be able to subsidize its organic farmers’ certification costs, and if it’s an expense that could be covered in larger states with many more farmers.

[quote position="full" is_quote="true"]Going fully organic was a massive milestone.[/quote]

If the tide is slow to change inside of India’s borders, exporting produce to nearby countries where organic consumption is booming might be the next best option, though not without its own set of hurdles. Located in the remote North, the small state of Sikkim currently lacks the infrastructure needed to expand its organic market; it is landlocked and far from large roads, and doesn’t yet have a cold storage chain or distribution centers needed for expanding sales in distant markets—which can take many days of travel to reach.

Also, more players are needed in the industry in order to help organic farmers fetch a higher price at the consumer and distribution levels. After all, what’s the point of making the state organic if farmers still have to compete alongside conventional produce without anyone to explain why organic is better in the first place?

“Beyond infrastructure, marketing, and retail, farmers are in need of a more intangible form of support. Empowering farmers to feel proud they’re making the switch is so important,” Gupta reports. Some experts in the field are concerned that farmer livelihood could be overshadowed by the organic label. “Somewhere along the way, in the celebration of organic farming practices, we’ve lost sight of the farmers themselves and the difficulties they face.”

The move away from GMOs is also gaining ground through other crops in India. On July 6, Monsanto withdrew an application to sell India its latest version of Bt cotton, a variety of genetically modified cotton seed. Pulling their application was a way for Monsanto, the world’s leading seed producer, to fight back against India’s restriction on how much money Monsanto could charge farmers in royalty fees for using their patented gene technology and seeds. The restrictions would have cost Monsanto millions of dollars worth of lost profits each year. Up until now, India has been the largest buyer of Monsanto seed outside of the U.S., and the largest producer of its cotton, but all of that could change with the decisive governmental shift away from genetically engineered crops and toward an organic future.

In the U.S., the organic industry is still very much in its adolescence. It’s growing nearly four times faster than the entire U.S. food market, earning record-breaking sales each year: $4.2 billion in 2015, according to the Organic Trade Association. The U.S. now holds the third most organic agricultural land in the world, behind Australia and Argentina, at 2.2 million hectares, but it’s still nowhere close to catching up in terms of scale with conventional agriculture, using less than one percent of America’s 370 million hectares of farmland.

While the appetite for organic food still outweighs supply in the U.S., India’s new state of organic fruits and vegetables are ripe and ready; the question is, when will India’s consumers finally be ready to dig in?

Professor shares how many years a friendship must last before it'll become lifelong