Congratulations! You’ve decided to take self-employment seriously. Following the sage advice of fellow freelancers, you’re starting off with the essentials: an anchor client for some reliable income, a strong social media presence for your burgeoning personal brand, and the self-discipline to work several hours a day sans nagging manager. What’s more, you’ve already clocked the time difference between your client’s home base in the U.S. and your new “office” on a beach in Thailand. The one thing you can’t control? Your unmoored status may be 21st century, but traditional contracts and modes of getting paid are woefully outdated. The Freelancers Union reports that one in two freelancers had trouble collecting payment in 2014. Here, a few ways to be a better bill collector—faster than you can say Phuket.

Don’t even think of starting without a contract.

We know how it goes: You hit it off with a potential client and rush forward in good faith because you’re passionate about the project. But do yourself a favor—hit the pause button and get it in writing. Define timelines for deliverables and payment that you feel are reasonable. Ensure there’s a fair kill fee if the project is canceled. Consider adding a 1.5 to 3 percent monthly fee for late payment (more than 30 days past due) to your contract, as well as a clause that entitles you to legal fees and costs if you have to hire a collection agency or attorney to recoup payment. (Keep in mind that this may ruffle some clients’ feathers, so weigh whether you still want to work with them if this addition is refused.) Request a 30 to 50 percent deposit for large or longer projects. Include language that ownership rights over work produced do not transfer to the client until full payment is received. Ask a lawyer buddy to look it over before you sign or, better yet, create a standard contract of your own for clients as a guideline. Shake, a free legal agreement app, is popular with the freelance set.

Get your cash, without it costing a fortune.

If you’ve temporarily set up shop at a café in Berlin, payment methods that rack up additional charges, like wire transfers, aren’t ideal. Neither are unreliable mailed checks. If direct deposit isn’t your thing, try a service like TransferWise, which utilizes a peer-to-peer currency exchange model, resulting in fees that are 90 percent lower than international transfers between banks. Or CoinPip, which allows users to send and receive Bitcoin or cash to bank accounts in less than five minutes for a 2 percent fee.

Still waiting? Send in Robin Hood.

There’s a burgeoning industry of for-hire bill collectors for freelancers, like former corporate finance pro Julie Elster of JustTellJulie.com. Elster chanced upon her venture two years ago while prodding her husband’s freelance clients to pony up. For a fee, Elster will help you collect without harming your business relationship. If all else fails, hire a lawyer. If you can’t afford one, search for pro-bono legal help—like Volunteer Lawyers for the Arts, which caters to low-income artists.

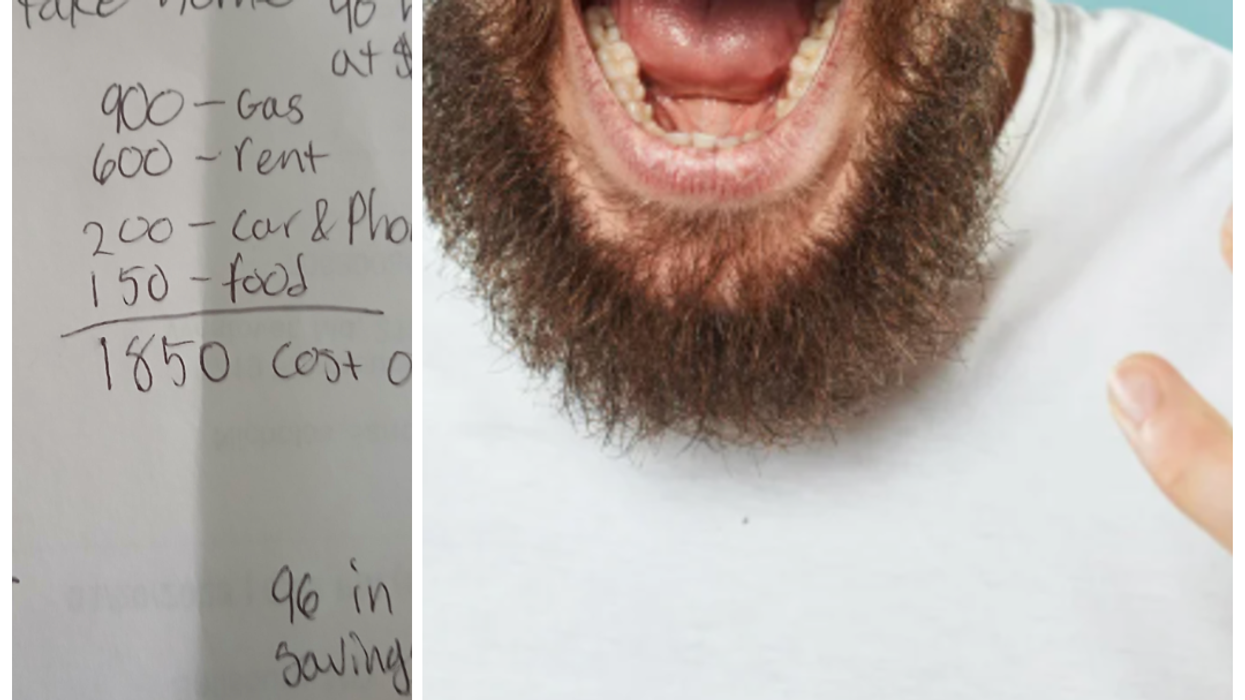

Take home pay is becoming less and less as expenses rise year after year.Photo credit: Canva

Take home pay is becoming less and less as expenses rise year after year.Photo credit: Canva Making bill payments gets harder each year.Photo credit: Canva

Making bill payments gets harder each year.Photo credit: Canva

Representative Image Source: Pexels | Olly

Representative Image Source: Pexels | Olly Representative Image Source: Pexels | Pixabay

Representative Image Source: Pexels | Pixabay Representative Image Source: Pexels | Cottonbro

Representative Image Source: Pexels | Cottonbro Representative Image Source: Pexels | Cottonbro

Representative Image Source: Pexels | Cottonbro Representative Image Source: Pexels | Karolina Grabowska

Representative Image Source: Pexels | Karolina Grabowska Representative Image Source: Pexels | Jonathan Borba

Representative Image Source: Pexels | Jonathan Borba Image Source: Reddit |

Image Source: Reddit |  Image Source: Reddit |

Image Source: Reddit |  Image Source: Reddit |

Image Source: Reddit |

Representative Image Source: Pexels | Pixabay

Representative Image Source: Pexels | Pixabay Representative Image Source: Pexels | Pixabay

Representative Image Source: Pexels | Pixabay Representative Image Source: Pexels | markus winkler

Representative Image Source: Pexels | markus winkler