The dated model of retirement is crumbling, yet there’s nothing concrete to replace it. Terrifying articles suggesting millennials save $2 million by retirement is laughable. But so is turning to a panel of financial advisors—whom don’t have an answer beyond, “I don’t know, dude, what do you want your retirement to look like?” Factor in the possibility that many of us may live to be 100, and it’s clear we need a fresh set of rules. Here, we plot a new retirement plan across five key milestones.

AGE: 25

Retirement relics say you should have the equivalent of a year’s salary saved by now, but that seems unlikely when there are student loans to pay down and a social life to be had. Don’t panic, but do start saving now—even as little as $25 a month can pay off handsomely in the long run. Stuart Scholten, investment adviser representative at NFP in the retirement division, recommends setting aside 12 to 15 percent of your gross annual pay starting now. If reading that figure makes you feel like hyperventilating, check out Digit, an app that analyzes your spending habits and tucks away extra money into your savings account without you ever missing it.

AGE: 35

Why not schedule a low-key coffee with an accountant, just to get the State of the Union on your finances? Or you can go hi-fi/low-interaction and download the Retire Logix app to help you plan for post-work life. (It’s free, so go ahead and save that 99 cents you thought you were about to fork over.) Also, now’s the time to create a diverse, long-term income stream. “Money saved for the future doesn’t have to be in an investment account,” says Pamela Capalad, founder of Brunch & Budget, a budgeting service for millennials. In today’s freelance economy, it may make sense to focus more on passive income streams than your 401(k)—things like buying and renting out a house, or building a business and hiring people who can take over the brunt of the work.

AGE: 55

Time to reinvent yourself. If you’re not utterly passionate about your job, start switching gears to something that’s more fulfilling or uses your skills in a new way. Getting excited about your job isn’t just for bright, young college graduates. Remember: You may end up taking a pay cut, but the goal is to find something you love to do and do it longer. Conversely, you may start making more money than ever before. You can always aim to shift upward—leaving the office but becoming an in-demand consultant, for example. “If you absolutely hate your job, and you just keep thinking about making it to 62, I tell people that maybe the right answer for you would be to take a lower-paying job at age 55 and work it until 70,” says Nancy Collamer, author of Second-Act Careers. “Play around with those numbers a bit. You may end up ahead.”

AGE: 85

Remember that house you bought back in your 30s? Time to kick out the renting whippersnappers and move in yourself—or turn it into an exclusive artists’ colony and start raking in those sweet, sweet residency fees.

AGE: 100

Congratulations, you made it! Hopefully you’re sprawled on a beach somewhere, leisurely checking the royalties from your tell-all memoir, Living the Thinkpiece: My Life as an Overanalyzed Millennial. Pour yourself a margarita and tell Jim the intern that you’ll be back in the office/treehouse/yurt/vegan coffee shop on Monday.

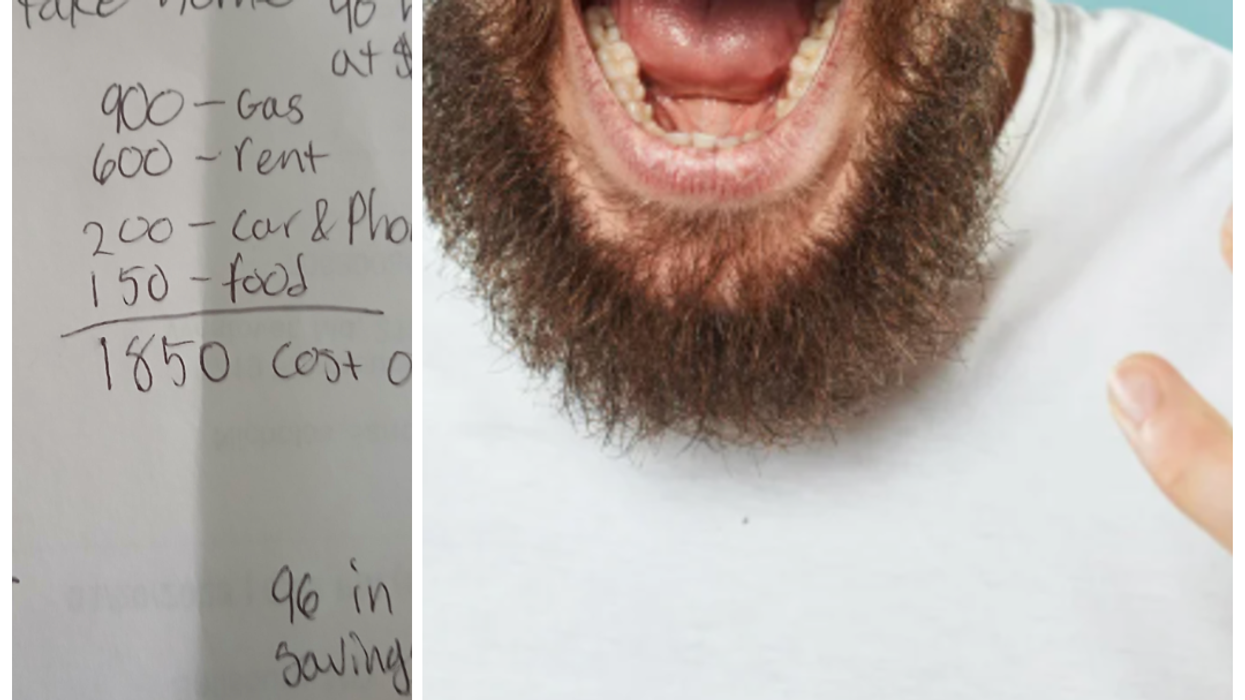

Take home pay is becoming less and less as expenses rise year after year.Photo credit: Canva

Take home pay is becoming less and less as expenses rise year after year.Photo credit: Canva Making bill payments gets harder each year.Photo credit: Canva

Making bill payments gets harder each year.Photo credit: Canva

Representative Image Source: Pexels | Olly

Representative Image Source: Pexels | Olly Representative Image Source: Pexels | Pixabay

Representative Image Source: Pexels | Pixabay Representative Image Source: Pexels | Cottonbro

Representative Image Source: Pexels | Cottonbro Representative Image Source: Pexels | Cottonbro

Representative Image Source: Pexels | Cottonbro Representative Image Source: Pexels | Karolina Grabowska

Representative Image Source: Pexels | Karolina Grabowska Representative Image Source: Pexels | Jonathan Borba

Representative Image Source: Pexels | Jonathan Borba Image Source: Reddit |

Image Source: Reddit |  Image Source: Reddit |

Image Source: Reddit |  Image Source: Reddit |

Image Source: Reddit |

Representative Image Source: Pexels | Pixabay

Representative Image Source: Pexels | Pixabay Representative Image Source: Pexels | Pixabay

Representative Image Source: Pexels | Pixabay Representative Image Source: Pexels | markus winkler

Representative Image Source: Pexels | markus winkler

Representative Image Source: Pexels | Shvets Production

Representative Image Source: Pexels | Shvets Production Representative Image Source: Pexels | Oleksandr P

Representative Image Source: Pexels | Oleksandr P Representative Image Source: Pexels | Photo by Spencer Selover

Representative Image Source: Pexels | Photo by Spencer Selover Representative Image Source: Pexels | JSME Mila

Representative Image Source: Pexels | JSME Mila