As the cost of college tuition continues to rise across the country, newly married couples are confronting tens of thousands of dollars in student loan debt. And with debt can also come a significant amount of stress, which only adds to the challenges that newlyweds face.

According to a 2013 study by a University of North Carolina assistant professor of economics and Jeffrey Thompson, a principal economist for the Federal Reserve System, a minimum of $10,000 in student loan debt is linked to couples being denied credit and filing for bankruptcy. And clearly, financial distress can cause strain on relationships—in fact, a 2015 study revealed that money issues were the leading cause of stress in relationships in the United States.

Across the country, college graduates are shouldering more student loan debt than ever before. The average amount of student loan debt from the class of 2016 was over $37,000, according to the Wall Street Journal, and the average debt-carrying U.S. household has $48,591 in student loans.

With an eye toward paying off student loan debt, here is how three newly married couples have been dealing with their student loans. Based on what they have to say, openness and staying judgment-free is key for not letting student loans create conflict in the early stages of marriage.

Amanda Kreklau, 30, and John Pipkin, 33, are a married couple who have a combined total of $415,000 in student loan debt. Amanda finished school with $260,000, and John graduated with $150,000.

What was it like when the two of you first discussed your student loan debt?

Kreklau: We started dating right before I graduated from undergrad and he had just graduated. He had no student debt then, but I must have had about $30,000-$40,000. I believe the conversation came up more than once, almost certainly when we discussed the fact that I was applying to graduate school and again when we discussed the discrepancy of our financial aid packages.

How has your student loan debt impacted your relationship emotionally?

Kreklau: One of our earliest arguments while dating was about my student loans. Not because of the number, but because my husband told his family about my student loans, which was information I consider private. Ultimately this led to a larger discussion about how much financial information we shared with both our families. And yes, some in his family didn't really approve of him dating someone with as much student loan debt as I had.

Have there been other financial challenges for you and your partner as a result of your student loan debt?

Kreklau: We went through a very tough period of being variously underpaid and out of work, and it was difficult to manage his student loan payments during that period. Other than that, I'm not sure if we have been impacted yet. The student loans don't seem to impact our credit scores much, and as far as I know we haven't had difficulty getting car loans or credit cards, but we have heard it may impact our ability to buy a house.

How do the two of you manage your student loan debt?

Kreklau: We kept our student loan payments separate, because we each have considered getting a public service position (which would eliminate some of our student loans after ten years). We also keep them separate in part because his graduate school is now under examination, lawsuits, and will possibly lose its accreditation. If it does, his portion of loans may be reduced or eliminated.

As far as paying them, we include our separate student loans as part of our overall household bills, and we split our bills proportionally. So right now he's paying his loan and I'm paying both of mine, and when he has extra cash he'll sometimes send an extra payment to one of my loans.

Do either or both of you ever feel emotionally overwhelmed by your student loan debt? How do you help one another cope?

Kreklau: John is more uncomfortable with debt in general, and it does wear on him. The main concern for us is that the current repayment plan for our federal loans eliminates the debt after 25 years, at which time there will be a big tax bill levied on the amount we get discharged. I try not to worry about that because who knows what congress will decide in the next 20 years as far as alleviating the burden of that system. That said, we try to manage our stress by a) making plans for how we will be able to handle that eventual tax bill and b) working hard to make more money now and pay down the rest of our debts. Concrete plans are a big relief from the stress of the future.

How much longer will it be before you are both student loan debt free?

Kreklau: My private student loan, I'm proud to say, we are hoping to pay off in another year or two. His federal loans have a small possibility of being discharged early. If not, then barring any changes by Congress, it'll be another 23 years or so.

Kelli Bamforth, 33, and Amanda Pate, 34, are a newly married couple who have a combined total of $108,000 of student loan debt.

When did you and your partner first discuss your student loan debt?

Bamforth: I'm not going to lie, it was a difficult conversation once I came clean about the extent of my debt. We probably started that conversation roughly two years into our relationship, when we started talking about moving in together. It wasn't a one-and-done conversation, it's something we have to revisit periodically.

Were either of you nervous about bringing up the subject of student loan debt?

Bamforth: I definitely was. A few years before my partner and I met, she had gone through bankruptcy, but by the time we got together, she had cleaned up her finances and has been very good with money ever since. Whereas, I was struggling when we met and ended up declaring bankruptcy roughly a year into our relationship. I was up front with her about the bankruptcy, but didn't feel comfortable discussing the true extent of my debt and credit issues for a few years. I felt embarrassed. But once I opened up to her, I realized there was no reason for me to feel that way, as she has been more than understanding and has helped me figure out a budget and debt repayment plan.

How has having student loan debt impacted your relationship?

Bamforth : Having debt definitely impacts our relationship, but I wouldn't say it's had a negative effect (though it might have in the beginning, when I was reluctant to be up front about my own debt). Now that she's graduated and will begin repaying her loans soon, it's definitely a factor in our financial discussions.

For example, we're thinking of selling our house and downsizing to a more affordable living space. If we do, we plan to put any money we make from the sale towards our student loan debt. If we decide to stay, we're thinking of refinancing and will put any potential cash back towards our loans, too. We're both committed to reducing our debt load so we can move forward with other life goals, such as traveling the world and (maybe) starting a family.

[quote position="full" is_quote="true"]It wasn't a one-and-done conversation, it's something we have to revisit periodically.[/quote]

Did getting married change the way either of you manage your debt as individuals and/ or as a couple?

Bamforth : We just got married in October, so we're still trying to figure out how it might change the way we approach our debt and overall finances. We're planning to hire an accountant who can help us decide how to best manage this stuff now that we're married. For example, should we change our tax withholdings? What's the best way to file our taxes at the end of the year? Those are questions we've been talking about for years, but it does take on a new importance now that we're married.

How do the two of you manage your student loan debt?

Bamforth : Right now, we each handle our student loan debt individually. It might change in the future, but for now it works for us.

How are you paying off your student loans?

Bamforth : I'm currently on an income-driven repayment plan. Since student loans are considered "good" debt (if there is such a thing), I'm concentrating on paying off my other debt, such as credit cards, personal loans and my federal tax burden. Once those debts are paid off, I'm planning to divert that money to my student loans to, hopefully, start reducing the principal faster. To be honest, though, I doubt I'll be able to fully pay off my loans; on an income-driven repayment plan, the balance is forgiven after 25 years and I fully anticipate having to take advantage of that.

Stephanie Bora, 29, and Sean Bodley, 28 are a married couple who started their relationship with $11,000 in Stephanie’s student loan debt, and $30,000 to $35,000 from Sean. Today, they are student loan debt-free.

At what point in your relationship did the topic of student loan debt come up?

Bora: Sean and I had been friends for a while before dating, so like lots of friends in school, we joked about our student debt, and that's how it first came up. We first truly discussed it when Sean graduated, because he finished undergrad a year before me. At that point we were dating and living separately, and he talked about it in the sense of trying to figure out how to budget with the new expense of student loan payments. It was a more stressful conversation for him than me, because I was still in school and not in any position to help. It was more like he was thinking out loud about financial planning. The next big time it came up was when we were planning on moving in together, because then we both had to budget paying rent, utilities, food, loans, etc.

How long did it take the two of you to pay off your loans?

Bora: Sean paid off his loans in 2013 after graduating in 2010. I paid off my debt in 2015 after graduating in 2011.

Did you pay your loans together, sharing each other's debt equally, or did you pay them off separately?

Bora: We both paid off our debt separately. I don't think we had tons of choice, Sean was starting an art business and my current Ph.D. stipend is hardly a big money maker, so we weren’t able to help one another out. I also had about three times as much debt as he had and didn't even want him to think about that as he was trying to start his business.

Did having student loan debt have an impact on your marriage?

Bora: Oh, of course it has impacted us! For Sean, there was a more of an emotional impact because his debt was an added stress in the hard work of starting a business. We came into a life together about $45,000 in the hole with the nice high interest rate of about 6.8 percent. It instilled a fear of debt (neither of us have credit cards), and instead of investing money or saving for a house, we wanted to be free of debt. I'm not sure our way was the best way, I think others maybe spread out their debt payments more to have more money for other things in life. But our student debt was this thing that was always scratching in the back of our minds.

What did it feel like to become student loan debt free as a couple?

Bora: It was a huge relief. Now we can put money into savings and build a better buffer. We have more income for other things, and can even start planning for retirement.

Do you have advice for couples who are dealing with student loan debt?

Bora: What we both wish we had done differently was to improve our financial literacy. If not to pay off debt differently, to have a better plan for money now that we're debt free. We also both advise that if you want to pay off your debt in a certain amount of time, figure out how much money you need to put aside each month, and stick to it. I wanted to be out of debt when I finished my Ph.D.—for me that meant $500–600/month and not a lot of social life or travel. It meant birthday and Christmas gifts from my family were loan payments, and Sean's family also gave gifts in the form of loan payments. It was not fun, but I'm hoping that if I get a “real” job after my Ph.D,, I can think about investing in the future rather than paying for my past education.

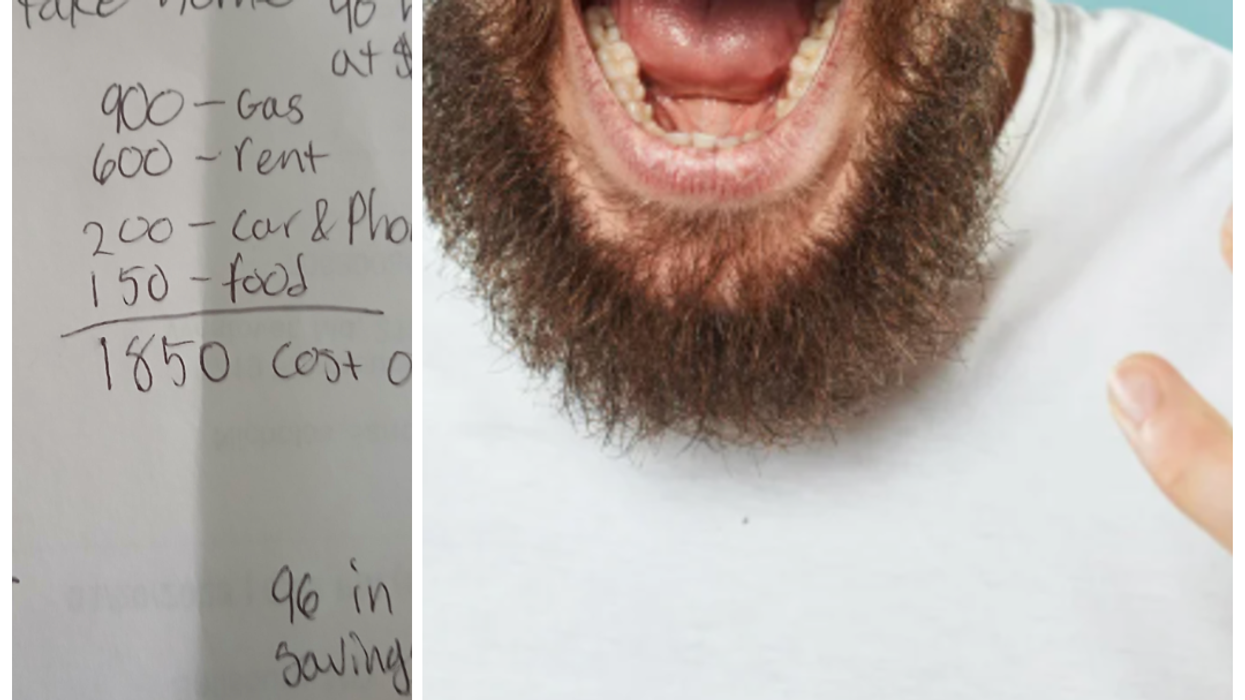

Take home pay is becoming less and less as expenses rise year after year.Photo credit: Canva

Take home pay is becoming less and less as expenses rise year after year.Photo credit: Canva Making bill payments gets harder each year.Photo credit: Canva

Making bill payments gets harder each year.Photo credit: Canva

Representative Image Source: Pexels | Olly

Representative Image Source: Pexels | Olly Representative Image Source: Pexels | Pixabay

Representative Image Source: Pexels | Pixabay Representative Image Source: Pexels | Cottonbro

Representative Image Source: Pexels | Cottonbro Representative Image Source: Pexels | Cottonbro

Representative Image Source: Pexels | Cottonbro Representative Image Source: Pexels | Karolina Grabowska

Representative Image Source: Pexels | Karolina Grabowska Representative Image Source: Pexels | Jonathan Borba

Representative Image Source: Pexels | Jonathan Borba Image Source: Reddit |

Image Source: Reddit |  Image Source: Reddit |

Image Source: Reddit |  Image Source: Reddit |

Image Source: Reddit |

Representative Image Source: Pexels | Pixabay

Representative Image Source: Pexels | Pixabay Representative Image Source: Pexels | Pixabay

Representative Image Source: Pexels | Pixabay Representative Image Source: Pexels | markus winkler

Representative Image Source: Pexels | markus winkler