Are you winging your financial future? By the looks of it, it seems that 66% of Americans don’t have a budget. But what if you did a staredown with your bank account? It may be intimidating, but it doesn’t have to be.

In this video, learn about the 50/20/30 Rule—the percentages that will help you remember how to divide your money for flexibility and security, right when that paycheck comes in.

And, for some Cliff’s Notes, here’s a rundown:

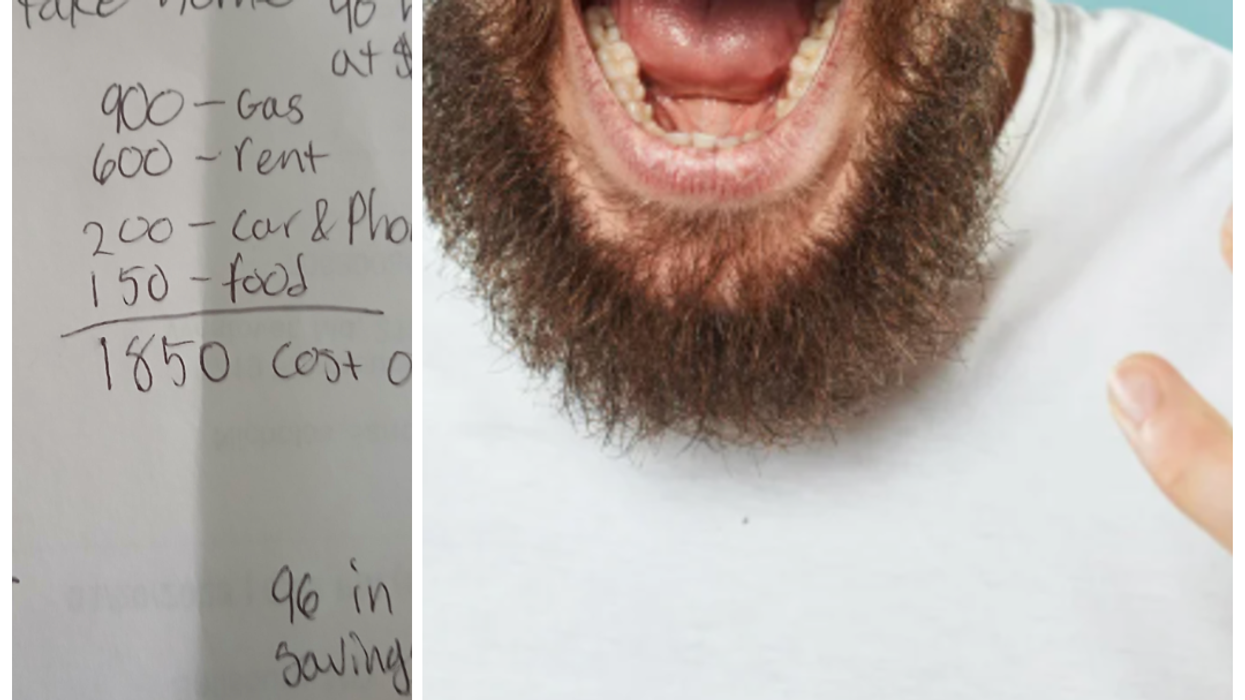

- 50 percent of your paycheck is for essentials—that fixed income that will go towards food, shelter, laundry, gas, water, power, phone, internet bills, and any potential emergencies if things go south.

- 20 percent of your paycheck will pay off those past debts and student loans, and let you invest in the future.

- 30 percent of your paycheck lets you save for that vacation or buy that special something for someone. Seems weird to not put 30% of your paycheck towards savings and debts, but think about it this way: living well lets you do good.

Watch the video to learn more about how your budget can let you save over time so that eventually, you can grow out of the 50/20/30 rule.

Take home pay is becoming less and less as expenses rise year after year.Photo credit: Canva

Take home pay is becoming less and less as expenses rise year after year.Photo credit: Canva Making bill payments gets harder each year.Photo credit: Canva

Making bill payments gets harder each year.Photo credit: Canva

Representative Image Source: Pexels | Olly

Representative Image Source: Pexels | Olly Representative Image Source: Pexels | Pixabay

Representative Image Source: Pexels | Pixabay Representative Image Source: Pexels | Cottonbro

Representative Image Source: Pexels | Cottonbro Representative Image Source: Pexels | Cottonbro

Representative Image Source: Pexels | Cottonbro Representative Image Source: Pexels | Karolina Grabowska

Representative Image Source: Pexels | Karolina Grabowska Representative Image Source: Pexels | Jonathan Borba

Representative Image Source: Pexels | Jonathan Borba Image Source: Reddit |

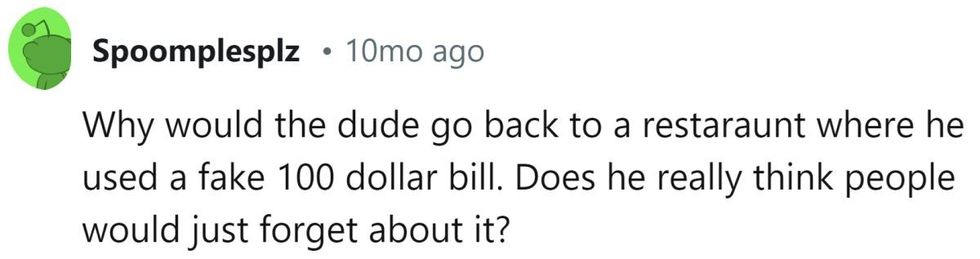

Image Source: Reddit |  Image Source: Reddit |

Image Source: Reddit |  Image Source: Reddit |

Image Source: Reddit |

Representative Image Source: Pexels | Pixabay

Representative Image Source: Pexels | Pixabay Representative Image Source: Pexels | Pixabay

Representative Image Source: Pexels | Pixabay Representative Image Source: Pexels | markus winkler

Representative Image Source: Pexels | markus winkler

Representative Image Source: Pexels | Shvets Production

Representative Image Source: Pexels | Shvets Production Representative Image Source: Pexels | Oleksandr P

Representative Image Source: Pexels | Oleksandr P Representative Image Source: Pexels | Photo by Spencer Selover

Representative Image Source: Pexels | Photo by Spencer Selover Representative Image Source: Pexels | JSME Mila

Representative Image Source: Pexels | JSME Mila