The list of highest-paid public employees always makes people angry. And understandably so.

The latest tally, released by 24/7 Wall Street, doesn’t include a single teacher, state legislator, councilor, or even a judge. Instead, it’s dominated by college coaches.

Alabama football coach Nick Saban made just over $7 million in 2015, narrowly edging Michigan’s Jim Harbaugh’s $7 million. Kentucky basketball coach John Calipari made $6.88 million, while football coaches Urban Meyer (Ohio State) and Bob Stoops (Oklahoma) each made $5.86 million in 2015.

By comparison, the average public school teacher salaries in those states for 2012-2013, according to the National Center for Education Statistics, are as follows:

- Alabama: $47,949

- Michigan: $61,560

- Kentucky: $50,326

- Ohio: $58,092

- Oklahoma: $44,128

The common refrain goes something like, “Why are we paying coaches so much when our teachers get so little?” And indeed, it’s hard to argue that teachers shouldn’t be paid much more than they are now.

But the argument isn’t that simple.

First, consider the amount of revenue these coaches bring to their institutions. Alabama’s championship-winning football program generated $95 million in revenue last year, marking a profit of nearly $50 million. To be fair, this is one of the most prominent programs in all of college football—not every program will have numbers in this stratosphere. The smaller programs won’t put up the kind of money for coaches, travel, and facilities that the Alabamas, Michigans, and Ohio States do. And many of these programs more than pay for themselves, but some do not; The Washington Post found that in 2014, 25 of the 48 teams in the five major college football conferences ran a deficit.

College basketball doesn’t bring in quite as much money, but the same debate applies. Former Connecticut coach Jim Calhoun, who won three national championships with the Huskies, got famously cranky when asked about his salary in relation to the state’s budget shortfall. Calhoun made $2.7 million in his final season of coaching.

Of the programs that do make money, where do the profits go? Are they filtered back to the school to support academics and infrastructure? Do athletic departments use the money to fund its slate of non-revenue sports? Or does the money go right back into the football or basketball programs?

In a perfect world, the answer probably would be all three. But a study of the University of Michigan’s athletic department revenue and expenditures for 2012-2013 showed the money was spent on football, basketball, and the rest of the teams. In fact, 20 different sports—including every women’s program—reported operating losses that year. The Michigan athletic program also filtered about $1 million back to the university for non-athletic scholarships.

OK, one might argue, “Then why not spend less on the coaching staff and put that money into supporting the other programs?” Colleges would argue that there are benefits to having a successful athletic program and there could be evidence to support this.

Past studies have varied greatly when trying to determine whether there is any positive impact on a school when its teams perform well. But a study by University of California, Berkeley professor Michael Anderson attempted to address shortcomings in the prior studies via a different mathematical model, and his findings point to the existence of positive benefits.

“We find that winning reduces acceptance rates and increases donations, applications, academic reputation, in-state enrollment, and incoming SAT scores,” Anderson says in the study, which was released in 2012.

Anderson finds that a three-win improvement for a school will lead to a 17 percent gain in alumni donations, a 3 percent increase in applications, a 1.3 percent decrease in acceptance rates—meaning the school is able to be more selective—an in-state enrollment increase of 1.8 percent, and a 0.2 percent increase in SAT scores.

A different study actually suggested that a college football program rising from “mediocre to great” could cause an increase in applications of 18.7 percent. Harvard professor Doug J. Chung’s paper asserts that to match that impact, a school would have to lower its tuition by 3.8 percent or bring in better faculty who would command 5 percent higher salaries.

Anderson says that return isn’t enough to justify the level of investment, but once increased athletic revenue is considered, the above benefits can be seen as a “bonus” on top of the new revenue. The problem here is that many programs don’t make money. One of the reasons: high spending.

[quote position="right" is_quote="true"]We find that winning reduces acceptance rates and increases donations, applications, academic reputation, in-state enrollment, and incoming SAT scores.[/quote]

In fact, some evidence suggests that increased spending on coaching salaries has no direct impact on success, save perhaps for the upper echelon of schools and coaches. And therein lies a large part of the problem.

The most successful—and profitable—schools set the bar and the rest are left chasing.

“Suppose 1,000 universities must decide whether to launch an athletic program, the initial cost of which would be $1 million a year,” Cornell economist Robert H. Frank wrote. “Those who launch a program then compete in an annual tournament in which finishers among the top 10 earn a prize of $10 million each... How many schools will decide to compete?”

Under that model, most would lose money. But the top programs would earn a huge profit.

The Washington Post equates it to an arms race:

Big-time college sports departments are making more money than ever before, thanks to skyrocketing television contracts, endorsement and licensing deals, and big-spending donors. But many departments also are losing more money than ever, as athletic directors choose to outspend rising income to compete in an arms race that is costing many of the nation’s largest publicly funded universities and students millions of dollars.

“Do any major sports programs make money for their universities? Sure, but the trick is to overspend and feed the myth that even the industry’s plutocrats teeter on insolvency,” former NCAA executive director Walter Byers once wrote in a memoir. “At the heart of the problem is an addiction to lavish spending.”

It’s not just college athletic programs who have that addiction. Just take a look at Hollywood’s top earners.

Dwayne Johnson has earned $64.5 million this year, according to Forbes. Jackie Chan? $61 million. Matt Damon has made $55 million—though that’s nothing compared to the fictional amount spent rescuing the guy. Jennifer Lawrence was the highest paid actress at $46 million, with Melissa McCarthy second at $33 million.

How about professional sports?

Fútbol superstar Cristiano Ronaldo is taking in $56 million this year, not including endorsements. Tops among American athletes is LeBron James at $23.2 million. Serena Williams’ $8.9 million places her atop the list of highest paid female athletes.

These are crazy amounts of money—amounts that easily dwarf those of college coaches. The obvious difference between these examples and college coaches is that the latter—in the cases of public universities—are paid by their respective states. But the similarity is that these salaries are market driven.

Dwayne Johnson makes $64.5 million because we go see his movies. Serena Williams is able to earn $8.9 million because women’s tennis is popular enough to offer large prize pools, though the pace is falling behind men’s tennis, which has everything to do with tournament attendance, sponsorship, and television contracts. And all of that is driven by attendance, viewership/advertiser reach, and merchandising.

In other words, it’s because we like to watch Serena play because she’s the best there is.

There’s a market. Just like there is with college athletics. Movie studios and professional sports franchises often lose money on projects or players, but they typically (a) make enough elsewhere to cover the shortfall, and (b) try to limit the bad choices.

Public education, for the most part, doesn’t have such a market driving up salaries—at least not to the same extent. That’s not an excuse, but rather an explanation. The priorities are set at several locations. For Hollywood, it’s the box office. For pro sports, it’s merchandising, concessions, and the ticket office. Tickets sold also applies to college athletics.

[quote position="right" is_quote="true"]The most successful—and profitable—schools set the bar, and the rest are left chasing.[/quote]

But it’s also set at various levels of government, especially via state budgets. And those are impacted by votes.

In other words, while a perfect-world scenario might see a chunk of Nick Saban’s salary redirected to teachers, scholarships, and academic programs, the reality of the economics is far more complex.

Athletics provide myriad benefits to campus and community, including around intangibles such as school pride. But huge expenditures likely aren’t strictly necessary to realize at least some level of these benefits. Again, it’s the top levels that skew the scale.

Would Alabama be as insanely successful with a coach other than Nick Saban? Would Connecticut have grown from a so-so regional basketball school into one of the most accomplished programs in the country without the work Jim Calhoun did? Perhaps, perhaps not.

But it only takes those examples, and a bunch of similar ones, to make many athletic programs break out the checkbook. And as long as the Sabans of the world keep winning, and fans keep spending, the coaches will keep getting paid.

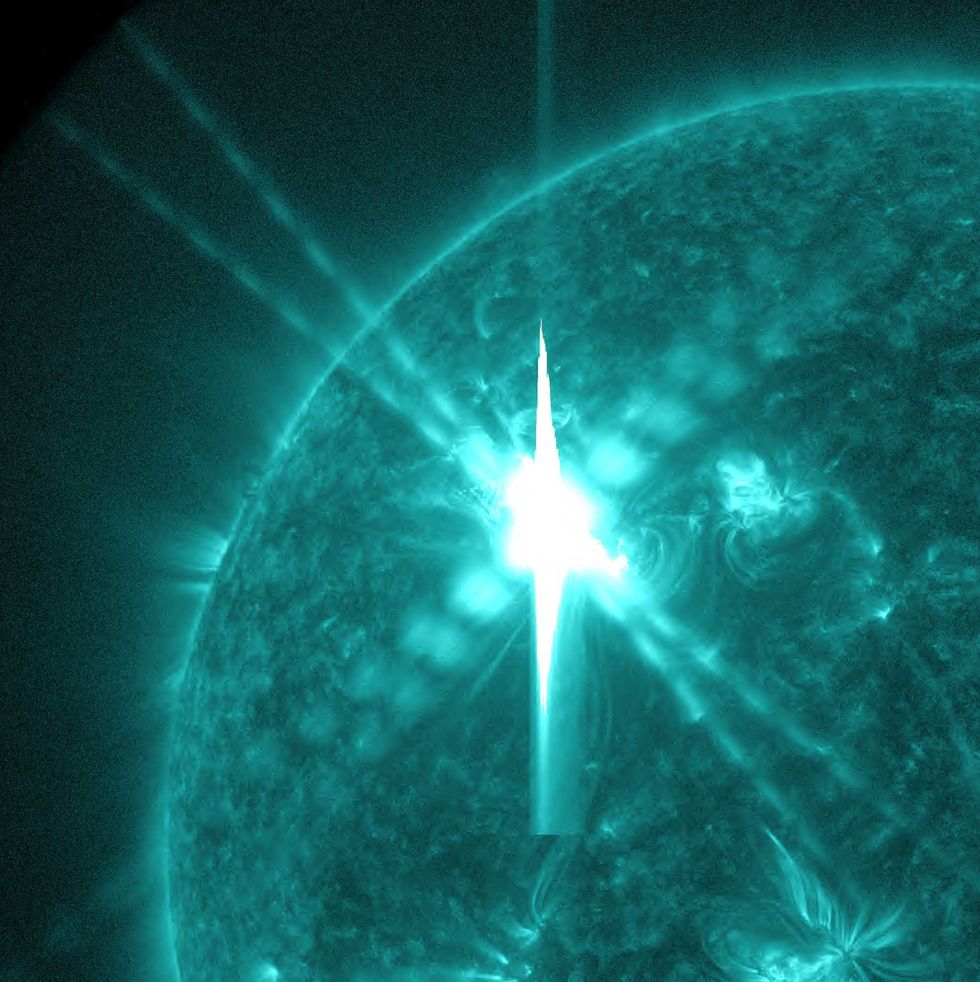

Image artifacts (diffraction spikes and vertical streaks) appearing in a CCD image of a major solar flare due to the excess incident radiation

Image artifacts (diffraction spikes and vertical streaks) appearing in a CCD image of a major solar flare due to the excess incident radiation

Ladder leads out of darkness.Photo credit

Ladder leads out of darkness.Photo credit  Woman's reflection in shadow.Photo credit

Woman's reflection in shadow.Photo credit  Young woman frazzled.Photo credit

Young woman frazzled.Photo credit

A woman looks out on the waterCanva

A woman looks out on the waterCanva A couple sits in uncomfortable silenceCanva

A couple sits in uncomfortable silenceCanva Gif of woman saying "I won't be bound to any man." via

Gif of woman saying "I won't be bound to any man." via  Woman working late at nightCanva

Woman working late at nightCanva Gif of woman saying "Happy. Independent. Feminine." via

Gif of woman saying "Happy. Independent. Feminine." via

Yonaguni Monument, as seen from the south of the formation.

Yonaguni Monument, as seen from the south of the formation.